Haier 2007 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167

|

|

157

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

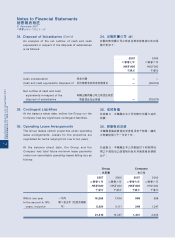

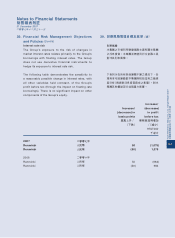

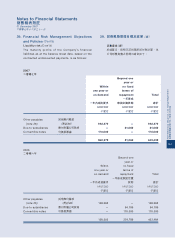

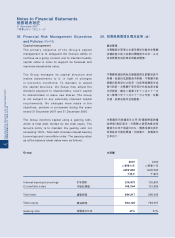

39. Financial Risk Management Objectives

and Policies (Cont’d)

Interest rate risk

The Group’s exposure to the risk of changes in

market interest rates relates primarily to the Group’s

borrowings with floating interest rates. The Group

does not use derivative financial instruments to

hedge its exposure to interest rate risk.

The following table demonstrates the sensitivity to

a reasonably possible change in interest rates, with

all other variables held constant, of the Group’s

profit before tax (through the impact on floating rate

borrowings). There is no significant impact on other

components of the Group’s equity.

Increase/

(decrease) in

basis points

Increase/

(decrease)

in profit

before tax

基點上升 /

(下跌)

除稅前溢利增加

/(減少)

HK$’000

千港元

2007 二零零七年

Renminbi 人民幣 50 (1,075)

Renminbi 人民幣 (50) 1,075

2006 二零零六年

Renminbi 人民幣 50 (684)

Renminbi 人民幣 (50) 684

39. 財務風險管理目標及政策

(續)

利率風險

本集團之市場利率變動風險主要有關本集團

之浮息借貸。本集團並無使用衍生金融工具

對沖其利率風險。

下表列示在所有其他變數不變之情況下,合

理利率可能變動對本集團除稅前溢利之敏感

度分析(透過對浮息借貸造成之影響)。對本

集團其他權益部分並無重大影響。