Haier 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

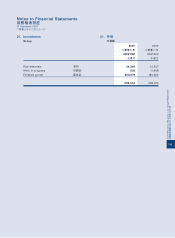

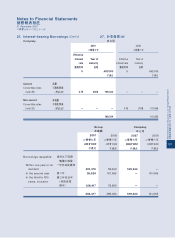

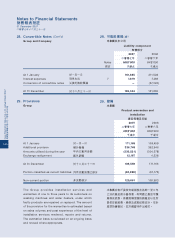

28. Convertible Notes

(Cont’d)

The fair value of the liability component of the

convertible notes was determined at the issuance

date, using the prevailing market interest rate for

similar debt without a conversion option of 4.75%

and is carried as a long term liability. The remaining

portion was allocated to the conversion option

that is recognised and included in shareholders’

equity. At the issuance date, the liability and equity

components of the convertible notes were split as to

HK$226,210,000 and HK$33,790,000, respectively.

During the year, there were no conversions of

convertible notes into ordinary shares of the

Company. Accordingly, the equity component

of the convertible notes remained unchanged

during the year and the liability component of the

convertible notes was increased by the amount of

corresponding finance costs of HK$7,679,000 (2006:

HK$7,459,000) during the year. At 31 December 2007,

the outstanding aggregate principal amount of the

convertible notes was HK$170 million (2006: HK$170

million).

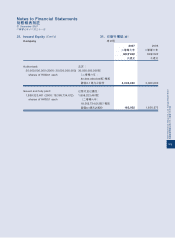

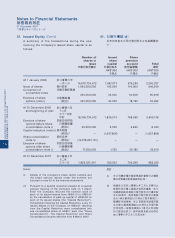

Subsequent to the balance sheet date, on 18 January

2008, the outstanding aggregate principal amount

of the convertible notes of HK$170 million were

fully converted, resulting in the issue of 94,444,444

additional ordinary shares of the Company.

Accordingly, there are additions of share capital

and share premium of approximately HK$9 million

and HK$183 million, respectively, and a reduction

in the equity component of the convertible notes of

approximately HK$22 million.

28. 可換股票據

(續)

可換股票據之負債部分公平值於發行日期

按同類債務(並無換股權)之當時市場利率

(4.75厘)釐定,並以長期負債列賬。剩餘

部分則分配至在股東權益確認入賬之換股

權。於發行日期,已分拆之可換股票據之

負債及權益部分分別為226,210,000 港元及

33,790,000港元。

年內,並無可換股票據兌換為本公司普通

股。因此,可換股票據之權益部分於年內保

持不變,而可換股票據之負債部分於年內則

增加相應融資成本7,679,000 港元(二零零

六年 ︰

7,459,000港元)之金額。於二零零

七年十二月三十一日,尚未兌換之可換股票

據本金總額為170,000,000港元(二零零六

年︰

170,000,000港元)。

於結算日後,於二零零八年一月十八日,尚

未兌換本金總額170,000,000 港元之可換股

票據已全數兌換,導致發行94,444,444股

本公司額外普通股。因此,股本及股份溢價

分別增加約9,000,000港元及183,000,000

港元,而可換股票據之權益部分則減少約

22,000,000港元。