Haier 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167

|

|

104

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

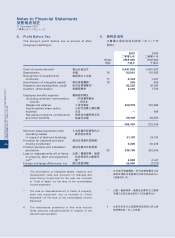

10. Tax

No provision for Hong Kong profits tax has been

made as the Group did not generate any assessable

profits arising in Hong Kong during the year (2006:

Nil).

Tax on profits assessable elsewhere in the PRC have

been calculated at the applicable PRC corporate

income tax (“CIT”) rates. Certain subsidiaries of

the Group are entitled to preferential tax treatments

including a reduction in CIT and a full exemption

from CIT for two years starting from their first profit-

making year followed by a 50% reduction in CIT for

the next consecutive three years.

Group

2007 2006

二零零七年 二零零六年

HK$’000 HK$’000

千港元 千港元

Current — Mainland China 即期 — 中國大陸 116,160 34,963

Deferred (note 30) 遞延

(附註30)

(19,901) 4,747

Total tax charge for the year 年內稅項支出總額 96,259 39,710

10. 稅項

年內,本集團並無任何源自香港之應課稅溢

利,因此並無作出香港利得稅撥備(二零零

六年:無)。

於中國其他地區就應課稅溢利之稅項,乃按

照中國企業所得稅(「企業所得稅」)適用稅

率計算。本集團若干附屬公司有權享有稅項

優惠待遇,包括獲扣減企業所得稅,以及自

首個獲利年度起計兩個年度獲全數豁免企業

所得稅,並於其後連續三年獲豁免50%企

業所得稅。

本集團