Haier 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

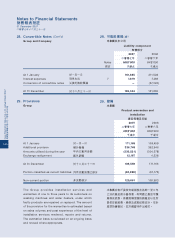

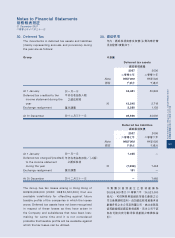

30. Deferred Tax

(Cont’d)

At 31 December 2007, there was no significant

unrecognised deferred tax liability (2006: Nil) for

taxes that would be payable on the unremitted

earnings of certain of the Group’s subsidiaries as the

Group has no liability to additional tax should such

amounts be remitted.

There are no income tax consequences attaching

to the payment of dividends by the Company to its

shareholders.

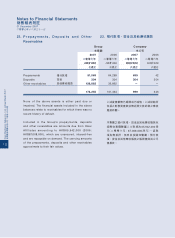

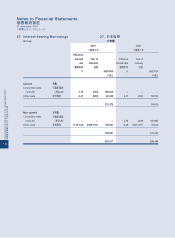

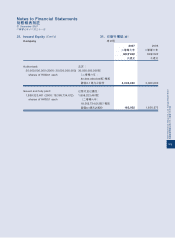

31. Issued Equity

Group

Issued equity

已發行權益

HK$’000

千港元

At 1 January 2006 於二零零六年一月一日 1,094,159

Conversion of convertible notes 兌換可換股票據 65,509

Exercise of share options 行使購股權 53,292

At 31 December 2006 and beginning of year 於二零零六年十二月三十一日及年初 1,212,960

Exercise of share options 行使購股權 35,250

At 31 December 2007 於二零零七年十二月三十一日 1,248,210

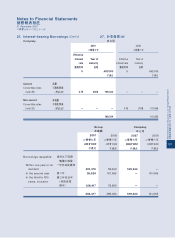

Due to the use of the reverse acquisition basis

of accounting, the amount of issued equity,

which includes share capital, share premium and

contributed surplus in the consolidated balance

sheet, represents the amount of issued equity of

legal subsidiaries acquired by the Company on 28

January 2005 and the amount of issued equity of

Haier Electrical Appliances Fourth Holdings (BVI)

Limited, a direct wholly-owned subsidiary of the

Company, and its then subsidiaries at 31 December

2006 plus equity changes of the Company resulting

from the exercise of share options and conversion of

convertible notes after the reverse acquisition. The

equity structure (i.e., the number and type of shares)

reflects the equity structure of the legal parent, Haier

Electronics Group Co., Ltd.

30. 遞延稅項

(續)

於二零零七年十二月三十一日,本集團概無

因匯寄該等款額產生額外稅項之負債,故此

並無有關若干本集團附屬公司未匯寄盈利之

應付稅項之重大未確認遞延稅項負債(二零

零六年 ︰無)。

本公司向其股東派付之股息概無附帶任何所

得稅後果。

31. 已發行權益

本集團

由於採用逆向收購會計法,故已發行權益之

金額(包括綜合資產負債表之股本、股份溢

價及繳入盈餘)指本公司於二零零五年一月

二十八日所收購各法定附屬公司之已發行權

益金額及本公司之直接全資附屬公司海爾電

器第四控股(BVI)有限公司及其當時附屬公

司於二零零六年十二月三十一日之已發行權

益金額。加上逆向收購後本公司因行使購股

權及兌換可換股票據而產生之權益變動。股

本架構(即股份數目及類別)反映法定母公司

海爾電器集團有限公司之權益架構。