Haier 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167

|

|

141

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

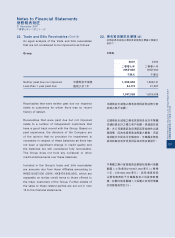

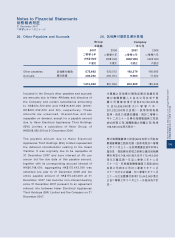

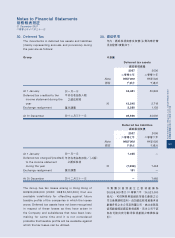

30. Deferred Tax

The movements in deferred tax assets and liabilities

(mainly representing accruals and provisions) during

the year are as follows:

Group

Deferred tax assets

遞延稅項資產

2007 2006

二零零七年 二零零六年

Note HK$’000 HK$’000

附註 千港元 千港元

At 1 January 於一月一日 34,681 30,824

Deferred tax credited to the

income statement during the

year

年內在收益表入賬

之遞延稅項

10 12,245 2,718

Exchange realignment 匯兌調整 2,580 1,139

At 31 December 於十二月三十一日 49,506 34,681

Deferred tax liabilities

遞延稅項負債

2007 2006

二零零七年 二零零六年

Note HK$’000 HK$’000

附註 千港元 千港元

At 1 January 於一月一日 7,46 5 —

Deferred tax charged/(credited)

to the income statement

during the year

年內在收益表扣除(入賬)

之遞延稅項

10 (7,656) 7, 4 6 5

Exchange realignment 匯兌調整 191 —

At 31 December 於十二月三十一日 —7,465

The Group has tax losses arising in Hong Kong of

HK$36,098,000 (2006: HK$34,523,000) that are

available indefinitely for offsetting against future

taxable profits of the companies in which the losses

arose. Deferred tax assets have not been recognised

in respect of these losses as they have arisen in

the Company and subsidiaries that have been loss-

making for some time and it is not considered

probable that taxable profits will be available against

which the tax losses can be utilised.

30. 遞延稅項

年內,遞延稅項資產及負債(主要為應計費

用及撥備)變動如下 ︰

本集團

本集團於香港產生之稅項虧損為

36,098,000港元(二零零六年:34,523,000

港元),可供無限期抵銷該等產生虧損之公

司日後應課稅溢利。由於遞延稅項資產來自

虧損多時之本公司及附屬公司,故此並無就

該等虧損確認遞延稅項資產,而本公司不認

為有可能出現可動用稅項虧損之應課稅溢

利。