Haier 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167

|

|

105

Haier Electronics Group Co., Ltd. Annual Report 2007

海爾電器集團有限公司 二零零七年年報

Notes to Financial Statements

財務報表附註

31 December 2007

二零零七年十二月三十一日

10. Tax

(Cont’d)

A reconciliation of the tax expense applicable to

profit/(loss) before tax using the statutory rates

for the jurisdictions in which the Company and its

subsidiaries are domiciled to the tax expense at

the effective tax rates, and a reconciliation of the

applicable rates (i.e., the statutory tax rates) to the

effective tax rates, are as follows:

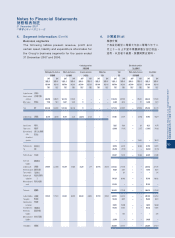

Group — 2007

Hong Kong

香港

Mainland China

中國大陸

Total

總計

HK$’000 % HK$’000 % HK$’000 %

千港元

%

千港元

%

千港元

%

Profit/(loss) before tax 除稅前溢利 /(虧

損) (32,320) 354,276 321,956

Tax at the statutory tax

rate

按法定稅率計算

之稅項 ( 5,65 6 ) 17. 5 116 ,911 33.0 111,25 5 34 .6

Income not subject to

tax

非課稅收入

(723) 2.2 — — (723) (0.2)

Expenses not deductible

for tax

不可扣稅開支

6,379 (19.7) 91,136 25.7 97,515 30.2

Tax losses not

recognised

未確認稅項虧損

— — 1,289 0.4 1,289 0.4

Tax exemption 稅項豁免 ——(113,077)(31.9)(113,077)

(35.1)

Tax charge at the

Group’s effective rate

按本集團之實際

稅率計算之稅

項支出 — — 96,259 27.2 96,259 29.9

Represented by: 代表:

Tax charge

attributable to

a discontinued

operation (note 12)

已終止經營業務

應佔之稅項支

出

(附註12)

—

Tax charge

attributable

to continuing

operations

持續經營業務應

佔之稅項支出

96,259

96,259

10. 稅項

(續)

按本公司及其附屬公司所在司法權區之法定

稅率計算除稅前溢利 /(虧損)之稅項支出,

與按實際稅率計算之稅項支出之對賬,以及

適用稅率(即法定稅率)與實際稅率之對賬如

下:

本集團 — 二零零七年