HP 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

and common stock equivalents and derivatives. See Note 9 for a further discussion on fair value of

financial instruments.

Derivative Financial Instruments

HP uses derivative financial instruments, primarily forwards, swaps, and options, to hedge certain

foreign currency and interest rate exposures. HP also may use other derivative instruments not

designated as hedges, such as forwards used to hedge foreign currency balance sheet exposures. HP

does not use derivative financial instruments for speculative purposes. See Note 10 for a full

description of HP’s derivative financial instrument activities and related accounting policies.

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and

post-retirement plans. HP generally amortizes unrecognized actuarial gains and losses on a straight-line

basis over the remaining estimated service life of participants. The measurement date for all HP plans

is October 31. See Note 16 for a full description of these plans and the accounting and funding

policies.

Loss Contingencies

HP is involved in various lawsuits, claims, investigations and proceedings that arise in the ordinary

course of business. HP records a loss provision when it believes it is both probable that a liability has

been incurred and the amount can be reasonably estimated. See Note 18 for a full description of HP’s

loss contingencies and related accounting policies.

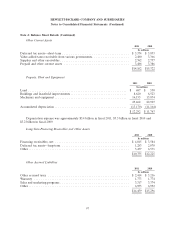

Note 2: Stock-Based Compensation

HP’s stock-based compensation plans include incentive compensation plans and an employee stock

purchase plan (‘‘ESPP’’).

Stock-Based Compensation Expense and Related Income Tax Benefits

Total stock-based compensation expense before income taxes for fiscal 2011, 2010 and 2009 was

$685 million, $668 million and $635 million, respectively. The resulting income tax benefit for fiscal

2011, 2010 and 2009 was $219 million, $216 million and $199 million, respectively.

Cash received from option exercises and purchases under the ESPP was $0.9 billion in fiscal 2011,

$2.6 billion in fiscal 2010 and $1.8 billion for fiscal 2009. The actual tax benefit realized for the tax

deduction from option exercises of the share-based payment awards in fiscal 2011, 2010 and 2009 was

$220 million, $414 million and $252 million, respectively.

Incentive Compensation Plans

HP’s incentive compensation plans include principal equity plans adopted in 2004 (as amended in

2010), 2000, 1995 and 1990 (‘‘principal equity plans’’), as well as various equity plans assumed through

acquisitions under which stock-based awards are outstanding. Stock-based awards granted from the

principal equity plans include performance-based restricted units (‘‘PRUs’’), stock options and

restricted stock awards. Employees meeting certain employment qualifications are eligible to receive

stock-based awards.

87