HP 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Operating Activities

Net cash provided by operating activities increased by approximately $0.7 billion for fiscal 2011, as

compared to fiscal 2010. The increase was due primarily to higher cash generated through the

utilization of operating assets, primarily accounts and financing receivables, and lower utilization of

cash resources for payment of accounts payable, the impact of which was partially offset by decrease in

net earnings and cash utilized as a result of higher inventory levels. Net cash provided by operating

activities decreased by approximately $1.5 billion for fiscal 2010, as compared to fiscal 2009. The

decrease was due primarily to an increase in accounts and financing receivables resulting from higher

revenues in the fourth quarter and higher payments for account payable activities, the impact of which

was partially offset by the increase in net earnings.

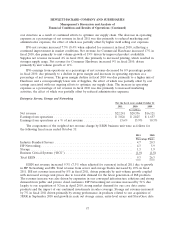

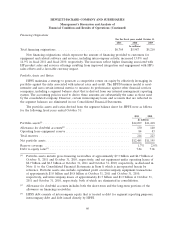

Our key working capital metrics are as follows:

October 31

2011 2010 2009

Days of sales outstanding in accounts receivable ........................... 51 50 48

Days of supply in inventory .......................................... 27 23 23

Days of purchases outstanding in accounts payable ......................... (52) (52) (57)

Cash conversion cycle .............................................. 26 21 14

Days of sales outstanding in accounts receivable (‘‘DSO’’) measures the average number of days

our receivables are outstanding. DSO is calculated by dividing ending accounts receivable, net of

allowance for doubtful accounts, by a 90-day average net revenue. Our accounts receivable balance was

$18.2 billion as of October 31, 2011.

Days of supply in inventory (‘‘DOS’’) measures the average number of days from procurement to

sale of our product. DOS is calculated by dividing ending inventory by a 90-day average cost of goods

sold. Our inventory balance was $7.5 billion as of October 31, 2011.

Days of purchases outstanding in accounts payable (‘‘DPO’’) measures the average number of days

our accounts payable balances are outstanding. DPO is calculated by dividing ending accounts payable

by a 90-day average cost of goods sold. Our accounts payable balance was $14.7 billion as of

October 31, 2011.

Our working capital requirements depend upon our effective management of the cash conversion

cycle, which represents effectively the number of days that elapse from the day we pay for the purchase

of raw materials to the collection of cash from our customers. The cash conversion cycle is the sum of

DSO and DOS less DPO.

The cash conversion cycle for fiscal 2011 increased by five days as compared to fiscal 2010. The

increase in DSO was primarily the result of unfavorable impact on receivables from the Autonomy

acquisition, extended payment terms and an increase in unbilled and aged accounts receivables, the

effect of which was offset by a favorable currency impact due to the strengthening U.S. dollar. The

increase in DOS was a result of higher inventory levels at October 31, 2011 due primarily to a macro

economic slow down impacting our consumer businesses, the timing of shipments in our commercial

hardware businesses and strategic purchases of certain components. DPO remained flat year over year.

The cash conversion cycle for fiscal 2010 increased by seven days as compared to fiscal 2009. The

increase in DSO was due primarily to linearity and fewer cash discounts in the fourth quarter. DOS

63