HP 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

HP Software gross margin increased in fiscal 2010 primarily as a result of a higher license and

support mix, the effect of which was partially offset by a reduced services gross margin rate.

HPFS gross margin increased in fiscal 2010 primarily as a result of higher portfolio margins due to

favorable financing conditions and higher remarketing margin, the effect of which was partially offset

by higher bad debt and lower buyout margin.

Corporate Investments gross margin increased in fiscal 2010 primarily as a result of the impact

from the acquisition Palm, Inc. (‘‘Palm’’).

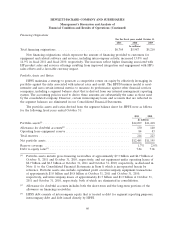

Operating Expenses

Research and Development

Total research and development (‘‘R&D’’) expense increased in fiscal 2011 due primarily to

additional expenses from acquired companies. In fiscal 2011, R&D expense increased for ESSN,

Corporate Investments and HP Software and decreased for Services and PSG. The increase for ESSN

was driven by acquisition investments and innovation-focused spend in networking and storage

products. The increase for Corporate Investments was due to investments in the development of

webOS and webOS devices during the first three quarters of fiscal 2011.

Total R&D expense increased in fiscal 2010 due primarily to additional expenses from acquired

companies. In fiscal 2010, R&D expense increased for ESSN, IPG, Corporate Investments, HP

Software and Services, and decreased for PSG.

Selling, General and Administrative

Selling, general and administrative (‘‘SG&A’’) expense increased in fiscal 2011 due primarily to

higher field selling costs as a result of our investments in sales resources to grow revenue. The increase

in fiscal 2011 was partially offset by $334 million in net gains on the sale of real estate and a

$77 million net gain on the divestiture of our Halo video collaboration products business. In fiscal 2011,

SG&A expense as a percentage of net revenue increased for each of our segments except for HPFS,

Services and IPG, each of which experienced a decrease.

Total SG&A expense increased in fiscal 2010 due primarily to higher field selling and marketing

costs as a result of our investments in sales resources to grow revenue. In fiscal 2010, SG&A expense

as a percentage of net revenue decreased for each of our segments except for IPG, which experienced

an increase.

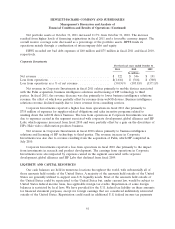

Amortization of Purchased Intangible Assets

The increase in amortization expense in fiscal 2011 was due primarily to increased amortization of

purchased intangible assets from acquisitions completed during fiscal 2010. This increase was partially

offset by decreased amortization expenses related to certain intangible assets associated with prior

acquisitions reaching the end of their amortization periods.

The decrease in amortization expense in fiscal 2010 was due primarily to certain intangible assets

associated with prior acquisitions reaching the end of their amortization periods, the effect of which

was partially offset by increased amortization of purchased intangible assets from acquisitions

completed during fiscal 2010.

51