HP 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

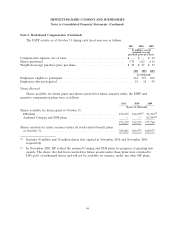

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

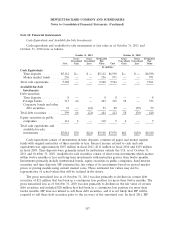

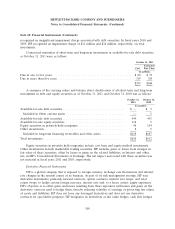

Note 4: Balance Sheet Details (Continued)

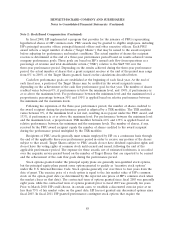

Other Liabilities

2011 2010

In millions

Pension, post-retirement, and post-employment liabilities .................... $ 5,414 $ 6,754

Deferred tax liability—long-term ..................................... 5,163 5,239

Long-term deferred revenue ........................................ 3,453 3,303

Other long-term liabilities .......................................... 3,490 3,765

$17,520 $19,061

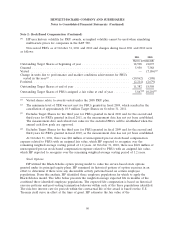

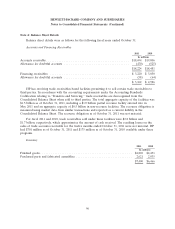

Note 5: Supplemental Cash Flow Information

Supplemental cash flow information to the Consolidated Statements of Cash Flows was as follows

for the following fiscal years ended October 31:

2011 2010 2009

In millions

Cash paid for income taxes, net .................................. $1,134 $1,293 $643

Cash paid for interest ......................................... $ 451 $ 384 $572

Non-cash investing and financing activities:

Issuance of common stock and stock awards assumed in business

acquisitions .............................................. $ 23 $ 93 $ —

Purchase of assets under financing arrangements .................... $ — $ — $283

Purchase of assets under capital leases ............................ $ 10 $ 122 $131

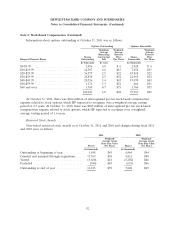

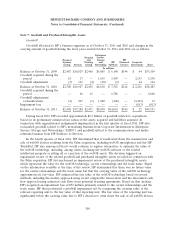

Note 6: Acquisitions

Acquisitions in fiscal 2011

In fiscal 2011, HP completed four acquisitions. The estimated fair value of the assets acquired and

liabilities assumed at the acquisition date for all four acquisitions, as set forth in the table below,

reflects various preliminary fair value estimates and analyses, including preliminary work performed by

third-party valuation specialists, which are subject to change within the measurement period as

valuations are finalized. The fair values of certain tangible assets and liabilities acquired, the valuation

of intangible assets acquired, certain legal matters, income and non-income-based taxes, and residual

goodwill are not yet finalized and subject to change. HP expects to continue to obtain information to

assist it in determining the fair value of the net assets acquired at the acquisition date during the

measurement period. Measurement period adjustments that HP determines to be material will be

applied retrospectively to the period of acquisition in HP’s Consolidated Financial Statements and,

depending on the nature of the adjustments, other periods subsequent to the period of acquisition

could also be affected.

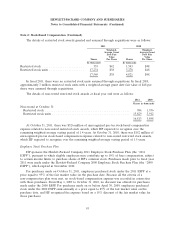

Pro forma results of operations for these acquisitions have not been presented because they are

not material to HP’s consolidated results of operations, either individually or in the aggregate.

Goodwill, which represents the excess of the fair value of purchase consideration over the net tangible

and intangible assets acquired, generally is not deductible for tax purposes.

98