HP 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Standard & Poor’s Ratings Services downgraded our short-term and long term ratings on

November 30, 2011, and Fitch Ratings Services downgraded our long term ratings on December 2,

2011. Accordingly, the ratings as of December 14, 2011 were:

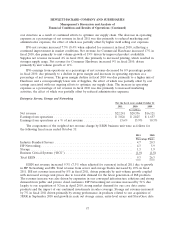

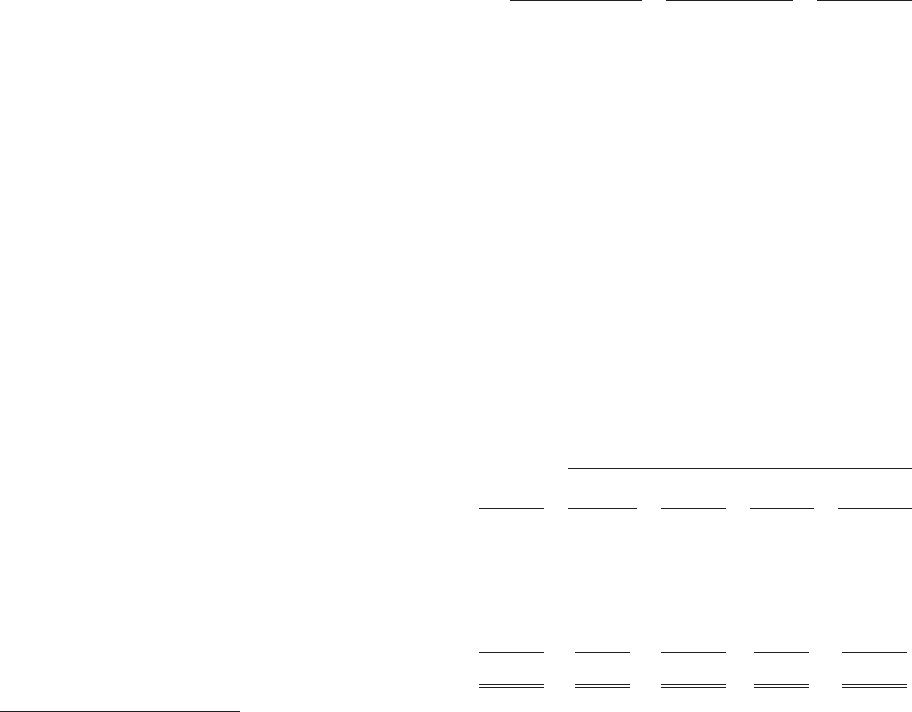

Standard & Poor’s Moody’s Investors Fitch Ratings

Ratings Services Service Services

Short-term debt ratings ....................... A-2 Prime-1 F1

Long-term debt ratings ....................... BBB+ A2 A

Our credit ratings remain under negative outlook by Fitch Ratings Services and have been under

review for possible downgrade by Moody’s Investors Service since October 28, 2011. While we do not

have any rating downgrade triggers that would accelerate the maturity of a material amount of our

debt, these downgrades have increased the cost of borrowing under our credit facilities, have reduced

market capacity for our commercial paper, and may require the posting of additional collateral under

some of our derivative contracts. In addition, any further downgrade in our credit ratings by any of the

three rating agencies may further impact us in a similar manner, and, depending on the extent of the

downgrade, could have a negative impact on our liquidity and capital position. We will rely on

alternative sources of funding, including drawdowns under our credit facilities or the issuance of debt

or other securities under our existing shelf registration statement, if necessary to offset reductions in

the market capacity for our commercial paper.

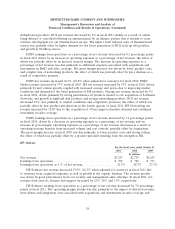

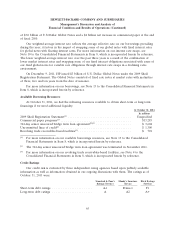

CONTRACTUAL AND OTHER OBLIGATIONS

The impact that we expect our contractual and other obligations as of October 31, 2011 to have on

our liquidity and cash flow in future periods is as follows:

Payments Due by Period

Less than More than

Total 1 Year 1-3 Years 3-5 Years 5 Years

In millions

Principal payments on long-term debt(1) ......... $25,953 $4,238 $10,476 $4,800 $ 6,439

Interest payments on long-term debt(2) .......... 5,064 651 993 643 2,777

Operating lease obligations .................. 3,283 811 1,112 650 710

Purchase obligations(3) ..................... 2,297 2,009 183 40 65

Capital lease obligations .................... 423 82 285 18 38

Total .................................. $37,020 $7,791 $13,049 $6,151 $10,029

(1) Amounts represent the expected principal cash payments relating to our long-term debt and do not

include any fair value adjustments or discounts and premiums.

(2) Amounts represent the expected interest cash payments relating to our long-term debt. We have

outstanding interest rate swap agreements accounted for as fair value hedges that have the

economic effect of modifying the fixed interest obligations associated with some of our fixed global

notes for variable rate obligations. The impact of these interest rate swaps was factored into the

calculation of the future interest payments on long-term debt.

(3) Purchase obligations include agreements to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms, including fixed or minimum quantities

to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

66