HP 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

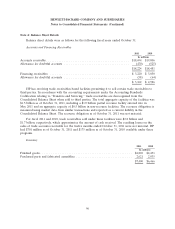

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

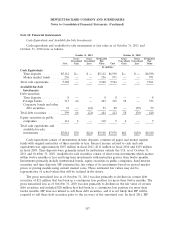

Note 7: Goodwill and Purchased Intangible Assets

Goodwill

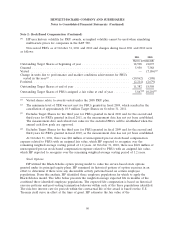

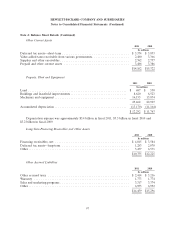

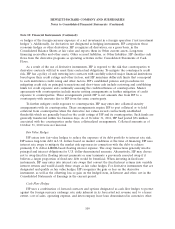

Goodwill allocated to HP’s business segments as of October 31, 2011 and 2010 and changes in the

carrying amount of goodwill during the fiscal years ended October 31, 2011 and 2010 are as follows:

Enterprise

Imaging Servers,

Personal and Storage HP

Systems Printing and HP Financial Corporate

Group Services Group Networking Software Services Investments Total

In millions

Balance at October 31, 2009 . . $2,487 $16,829 $2,460 $5,005 $ 6,140 $144 $ 44 $33,109

Goodwill acquired during the

period ................ 18 17 — 1,635 1,407 — 2,153 5,230

Goodwill adjustments ....... (5) 121 (4) (30) (2) — 64 144

Balance at October 31, 2010 . . $2,500 $16,967 $2,456 $6,610 $ 7,545 $144 $ 2,261 $38,483

Goodwill acquired during the

period ................ — 66 16 — 6,786 — — 6,868

Goodwill adjustments/

reclassifications .......... (2) 247 (1) 1,460 (268) — (1,423) 13

Impairment loss ........... — — — — — — (813) (813)

Balance at October 31, 2011 . . $2,498 $17,280 $2,471 $8,070 $14,063 $144 $ 25 $44,551

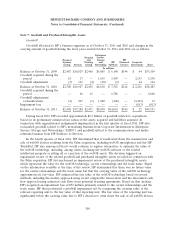

During fiscal 2011, HP recorded approximately $6.9 billion of goodwill related to acquisitions

based on its preliminary estimated fair values of the assets acquired and liabilities assumed. In

connection with organizational realignments implemented in the first quarter of fiscal 2011, HP also

reclassified goodwill related to HP’s networking business from Corporate Investments to Enterprise

Servers, Storage and Networking (‘‘ESSN’’) and goodwill related to the communications and media

solutions business from HP Software to Services.

In the fourth quarter of fiscal 2011, HP determined that it would wind down the manufacture and

sale of webOS devices resulting from the Palm acquisition, including webOS smartphones and the HP

TouchPad. HP also announced that it would continue to explore alternatives to optimize the value of

the webOS technology, including, among others, licensing the webOS software or the related

intellectual property or selling all or a portion of the webOS assets. The decision triggered an

impairment review of the related goodwill and purchased intangible assets recorded in connection with

the Palm acquisition. HP first performed an impairment review of the purchased intangible assets,

which represents the value for the webOS technology, carrier relationships and the trade name. Based

on the information available at the time of the review, HP determined that there was no future value

for the carrier relationships and the trade name but that the carrying value of the webOS technology

approximates its fair value. HP estimated the fair value of the webOS technology based on several

methods, including the market approach using recent comparable transactions and the discounted cash

flow approach using estimated cash flows from potential licensing agreements. Based on that analysis,

HP recognized an impairment loss of $72 million primarily related to the carrier relationships and the

trade name. HP then performed a goodwill impairment test by comparing the carrying value of the

relevant reporting unit to the fair value of that reporting unit. The fair value of the reporting unit was

significantly below the carrying value due to HP’s decision to wind down the sale of all webOS devices.

100