HP 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

choosing, be it in-house, outsourced as a service via the Internet or via a hybrid environment. Our

portfolio of management software completes the package by allowing our customers to manage their IT

operations in an efficient and cost-effective manner. In addition, we are working to optimize our supply

chain by eliminating complexity, reducing fixed costs, and leveraging our scale to ensure the availability

of components at favorable prices even during shortages. We are also expanding our use of industry

standard components in our enterprise products to further leverage our scale.

Investing in our Business

We are investing in our business to strengthen our position in our core markets and accelerate

growth in adjacent markets in anticipation of market trends, such as cloud computing, unstructured

data, data center consolidation and automation, digitization, analytics and IT security. We are also

creating innovative new products and developing new channels to connect with our customers. In

addition, we have been making focused investments to strengthen our portfolio of products and services

that we can offer to our customers, both through organic investments as well as through acquisitions.

These investments will allow us to expand in higher margin and higher growth industry segments and

further strengthen our portfolio of hardware, software and services.

Driving Operational Effectiveness

We are continuing to work to optimize operational effectiveness across the company. Operational

effectiveness remains critical to the success of HP, and we are implementing efficiency, productivity and

quality initiatives throughout the company. For example, we are continuing to execute our ongoing

initiatives to transform our supply chain and leverage our corporate infrastructure. We have also

adopted an initiative to implement better tools, standardize key processes, integrate critical IT systems,

minimize redundant or legacy systems and take other actions to improve our productivity, sales,

forecasting and business decisions. In addition, we are continuing to implement the multi-year

restructuring plan announced in June 2010 relating to our enterprise services business. See Note 8 to

the Consolidated Financial Statements in Item 8 for further discussion of this restructuring plan and

the associated restructuring charges.

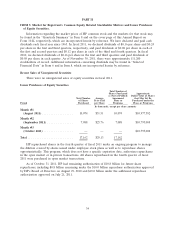

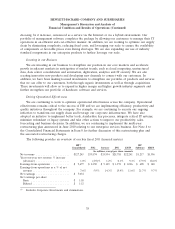

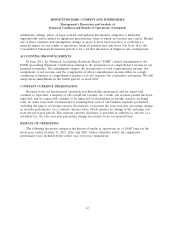

The following provides an overview of our key fiscal 2011 financial metrics:

HP(1) HP

Consolidated PSG Services IPG ESSN Software HPFS

In millions, except per share amounts

Net revenue .................... $127,245 $39,574 $35,954 $25,783 $22,241 $3,217 $3,596

Year-over-year net revenue % increase

(decrease) .................... 1.0% (2.9)% 1.2% 0.1% 9.3% 17.9% 18.0%

Earnings from operations ........... $ 9,677 $ 2,350 $ 5,149 $ 3,973 $ 3,026 $ 698 $ 348

Earnings from operations as a % of net

revenue ...................... 7.6% 5.9% 14.3% 15.4% 13.6% 21.7% 9.7%

Net earnings .................... $ 7,074

Net earnings per share

Basic ....................... $ 3.38

Diluted ...................... $ 3.32

(1) Includes Corporate Investments and eliminations.

38