HP 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

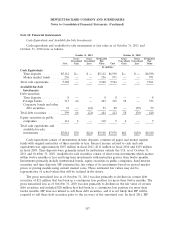

Note 10: Financial Instruments (Continued)

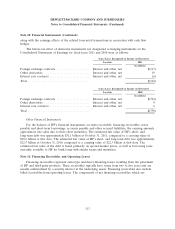

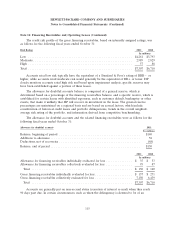

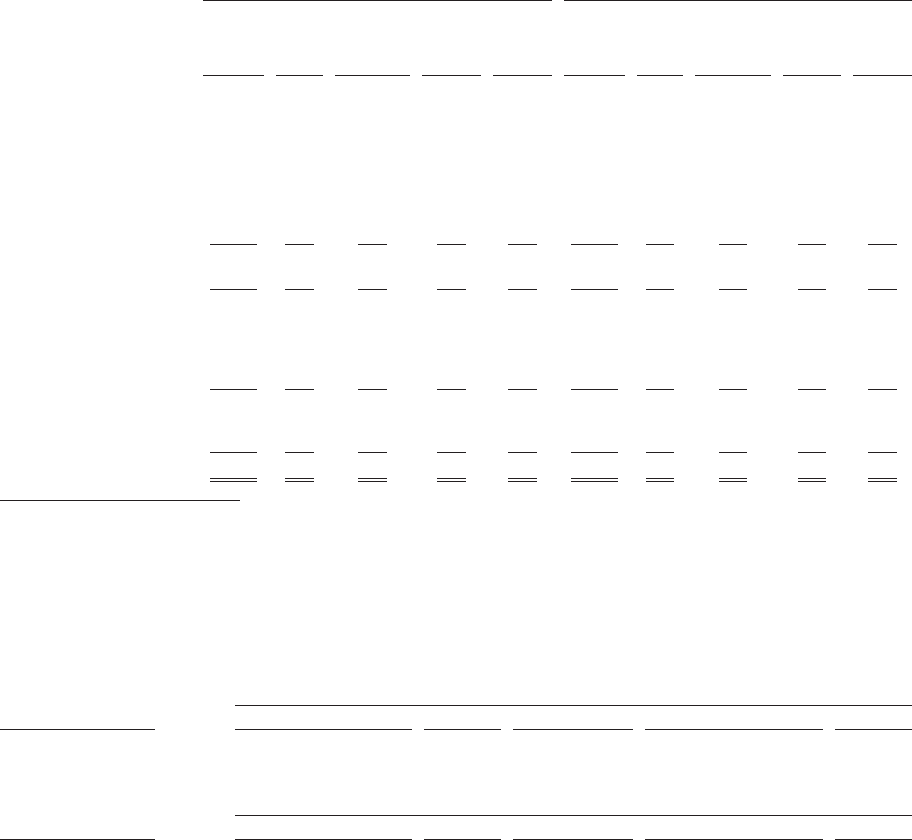

Fair Value of Derivative Instruments in the Consolidated Balance Sheets

As discussed in Note 9, HP estimates the fair values of derivatives primarily based on pricing

models using current market rates and records all derivatives on the balance sheet at fair value. The

gross notional and fair value of derivative financial instruments in the Consolidated Balance Sheets was

recorded as follows:

As of October 31, 2011 As of October 31, 2010

Long-term Long-term

Financing Financing

Other Receivables Other Other Receivables Other

Gross Current and Accrued Other Gross Current and Accrued Other

Notional(1) Assets Other Assets Liabilities Liabilities Notional(1) Assets Other Assets Liabilities Liabilities

In millions

Derivatives designated as

hedging instruments

Fair value hedges:

Interest rate contracts . . . $10,075 $ 30 $508 $ — $ — $ 8,575 $ — $656 $ — $ —

Cash flow hedges:

Foreign exchange contracts 21,666 192 30 324 126 16,862 98 20 503 83

Net investment hedges:

Foreign exchange contracts 1,556 7 4 44 56 1,466 8 2 58 62

Total derivatives designated as

hedging instruments ..... 33,297 229 542 368 182 26,903 106 678 561 145

Derivatives not designated as

hedging instruments

Foreign exchange contracts . . 13,994 66 5 244 38 13,701 51 3 129 55

Interest rate contracts(2) .... 2,200 — 55 — 71 2,200 — 79 — 89

Other derivatives ........ 410 25 6 — 1 397 5 6 — —

Total derivatives not

designated as hedging

instruments .......... 16,604 91 66 244 110 16,298 56 88 129 144

Total derivatives ........ $49,901 $320 $608 $612 $292 $43,201 $162 $766 $690 $289

(1) Represents the face amounts of contracts that were outstanding as of October 31, 2011 and October 31, 2010, respectively.

(2) Represents offsetting swaps acquired through previous business combinations that were not designated as hedging instruments.

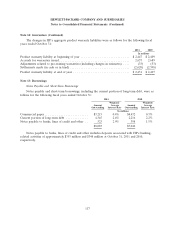

Effect of Derivative Instruments on the Consolidated Statements of Earnings

The before-tax effect of a derivative instrument and related hedged item in a fair value hedging

relationship for fiscal years ended October 31, 2011 and October 31, 2010 was as follows:

Gain (Loss) Recognized in Income on Derivative and Related Hedged Item

Derivative Instrument Location 2011 Hedged Item Location 2011

In millions In millions

Interest rate contracts Interest and other, net $(119) Fixed-rate debt Interest and other, net $128

Gain (Loss) Recognized in Income on Derivative and Related Hedged Item

Derivative Instrument Location 2010 Hedged Item Location 2010

In millions In millions

Interest rate contracts Interest and other, net $316 Fixed-rate debt Interest and other, net $(299)

111