HP 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

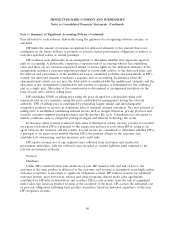

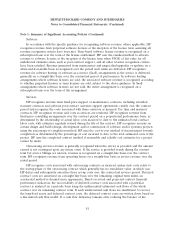

Note 1: Summary of Significant Accounting Policies (Continued)

part of the fair value of purchase consideration, and restructuring costs were included as a part of the

assumed obligation in deriving the fair value of purchase consideration allocation.

Goodwill and Purchased Intangible Assets

Goodwill and purchased intangible assets with indefinite useful lives are not amortized but are

tested for impairment at least annually. HP reviews goodwill and purchased intangible assets with

indefinite lives for impairment annually at the beginning of its fourth fiscal quarter and whenever

events or changes in circumstances indicate the carrying value of an asset may not be recoverable. For

goodwill, HP performs a two-step impairment test. In the first step, HP compares the fair value of each

reporting unit to its carrying value. In general, HP’s reporting units are consistent with the reportable

segments identified in Note 19. However, for the webOS business within the Corporate Investments

segment, the reporting unit is one step below the reporting segment level. HP determines the fair

values of its reporting units based on a weighting of income and market approaches. Under the income

approach, HP calculates the fair value of a reporting unit based on the present value of estimated

future cash flows. Under the market approach, HP estimates the fair value based on market multiples

of revenue or earnings for comparable companies. If the fair value of the reporting unit exceeds the

carrying value of the net assets assigned to that unit, goodwill is not impaired and no further testing is

performed. If the carrying value of the net assets assigned to the reporting unit exceeds the fair value

of the reporting unit, then HP must perform the second step of the impairment test in order to

determine the implied fair value of the reporting unit’s goodwill. If the carrying value of a reporting

unit’s goodwill exceeds its implied fair value, HP records an impairment loss equal to the difference.

HP estimates the fair value of indefinite-lived purchased intangible assets using an income

approach. HP recognizes an impairment loss when the estimated fair value of the indefinite-lived

purchased intangible assets is less than the carrying value.

HP amortizes purchased intangible assets with finite lives using the straight-line method over the

estimated economic lives of the assets, ranging from one to ten years.

Long-Lived Asset Impairment

HP evaluates property, plant and equipment and purchased intangible assets with finite lives for

impairment whenever events or changes in circumstances indicate the carrying value of an asset may

not be recoverable. HP assesses the recoverability of the assets based on the undiscounted future cash

flow and recognizes an impairment loss when the estimated undiscounted future cash flow expected to

result from the use of the asset plus the net proceeds expected from disposition of the asset, if any, are

less than the carrying value of the asset. When HP identifies an impairment, HP reduces the carrying

amount of the asset to its estimated fair value based on a discounted cash flow approach or, when

available and appropriate, to comparable market values.

Fair Value of Financial Instruments

HP measures certain financial assets and liabilities at fair value based on the exchange price that

would be received for an asset or paid to transfer a liability (an exit price) in the principal or most

advantageous market for the asset or liability in an orderly transaction between market participants.

Financial instruments are primarily comprised of time deposits, money market funds, commercial

paper, corporate and other debt securities, equity securities and other investments in common stock

86