HP 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

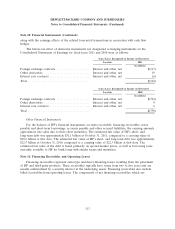

Note 10: Financial Instruments (Continued)

or hedges of the foreign currency exposure of a net investment in a foreign operation (‘‘net investment

hedges’’). Additionally, for derivatives not designated as hedging instruments, HP categorizes those

economic hedges as other derivatives. HP recognizes all derivatives, on a gross basis, in the

Consolidated Balance Sheets at fair value and reports them in Other current assets, Long-term

financing receivables and other assets, Other accrued liabilities, or Other liabilities. HP classifies cash

flows from the derivative programs as operating activities in the Consolidated Statements of Cash

Flows.

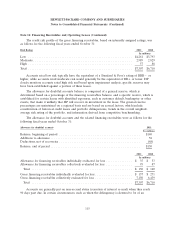

As a result of the use of derivative instruments, HP is exposed to the risk that counterparties to

derivative contracts will fail to meet their contractual obligations. To mitigate the counterparty credit

risk, HP has a policy of only entering into contracts with carefully selected major financial institutions

based upon their credit ratings and other factors, and HP maintains dollar risk limits that correspond

to each institution’s credit rating and other factors. HP’s established policies and procedures for

mitigating credit risk on principal transactions and short-term cash include reviewing and establishing

limits for credit exposure and continually assessing the creditworthiness of counterparties. Master

agreements with counterparties include master netting arrangements as further mitigation of credit

exposure to counterparties. These arrangements permit HP to net amounts due from HP to a

counterparty with amounts due to HP from the same counterparty.

To further mitigate credit exposure to counterparties, HP may enter into collateral security

arrangements with its counterparties. These arrangements require HP to post collateral or to hold

collateral from counterparties when the derivative fair values exceed contractually established

thresholds which are generally based on the credit ratings of HP and its counterparties. Such funds are

generally transferred within two business days. As of October 31, 2011, HP had posted $96 million

associated with the counterparties under these collateralized arrangements. Collateral amounts as of

October 31, 2010 were not material.

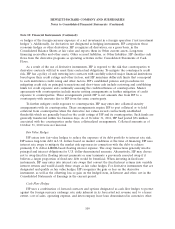

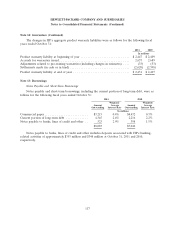

Fair Value Hedges

HP enters into fair value hedges to reduce the exposure of its debt portfolio to interest rate risk.

HP issues long-term debt in U.S. dollars based on market conditions at the time of financing. HP uses

interest rate swaps to mitigate the market risk exposures in connection with the debt to achieve

primarily U.S. dollar LIBOR-based floating interest expense. The swap transactions generally involve

principal and interest obligations for U.S. dollar-denominated amounts. Alternatively, HP may choose

not to swap fixed for floating interest payments or may terminate a previously executed swap if it

believes a larger proportion of fixed-rate debt would be beneficial. When investing in fixed-rate

instruments, HP may enter into interest rate swaps that convert the fixed interest returns into variable

interest returns and would classify these swaps as fair value hedges. For derivative instruments that are

designated and qualify as fair value hedges, HP recognizes the gain or loss on the derivative

instrument, as well as the offsetting loss or gain on the hedged item, in Interest and other, net in the

Consolidated Statements of Earnings in the current period.

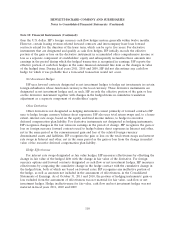

Cash Flow Hedges

HP uses a combination of forward contracts and options designated as cash flow hedges to protect

against the foreign currency exchange rate risks inherent in its forecasted net revenue and, to a lesser

extent, cost of sales, operating expense, and intercompany lease loan denominated in currencies other

109