HP 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

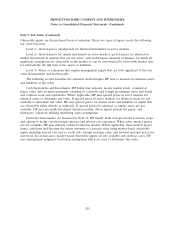

Note 10: Financial Instruments

Cash Equivalents and Available-for-Sale Investments

Cash equivalents and available-for-sale investments at fair value as of October 31, 2011 and

October 31, 2010 were as follows:

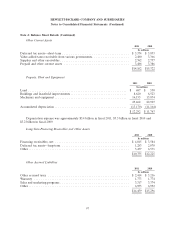

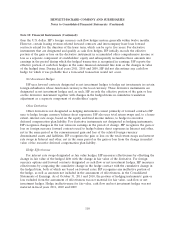

October 31, 2011 October 31, 2010

Gross Gross Estimated Gross Gross Estimated

Unrealized Unrealized Fair Unrealized Unrealized Fair

Cost Gain Loss Value Cost Gain Loss Value

In millions

Cash Equivalents

Time deposits .......... $5,112 $— $ — $5,112 $6,590 $— $ — $6,590

Money market funds ..... 236 — — 236 971 — — 971

Total cash equivalents ...... 5,348 — — 5,348 7,561 — — 7,561

Available-for-Sale

Investments

Debt securities:

Time deposits .......... 8 — — 8 8 — — 8

Foreign bonds .......... 317 66 — 383 315 58 — 373

Corporate bonds and other

debt securities ........ 74 — (21) 53 89 — (30) 59

Total debt securities ....... 399 66 (21) 444 412 58 (30) 440

Equity securities in public

companies ............. 114 4 — 118 5 4 — 9

Total cash equivalents and

available-for-sale

investments ............ $5,861 $70 $(21) $5,910 $7,978 $62 $(30) $8,010

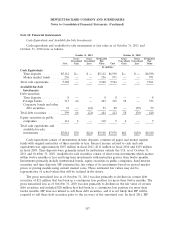

Cash equivalents consist of investments in time deposits, commercial paper and money market

funds with original maturities of three months or less. Interest income related to cash and cash

equivalents was approximately $167 million in fiscal 2011, $111 million in fiscal 2010 and $119 million

in fiscal 2009. Time deposits were primarily issued by institutions outside the U.S. as of October 31,

2011 and October 31, 2010. Available-for-sale securities consist of short-term investments which mature

within twelve months or less and long-term investments with maturities greater than twelve months.

Investments primarily include institutional bonds, equity securities in public companies, fixed-interest

securities and time deposits. HP estimates the fair values of its investments based on quoted market

prices or pricing models using current market rates. These estimated fair values may not be

representative of actual values that will be realized in the future.

The gross unrealized loss as of October 31, 2011 was due primarily to declines in certain debt

securities of $21 million that has been in a continuous loss position for more than twelve months. The

gross unrealized loss as of October 31, 2010 was due primarily to declines in the fair value of certain

debt securities and included $28 million that had been in a continuous loss position for more than

twelve months. HP does not intend to sell these debt securities, and it is not likely that HP will be

required to sell these debt securities prior to the recovery of the amortized cost. In fiscal 2011, HP

107