HP 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

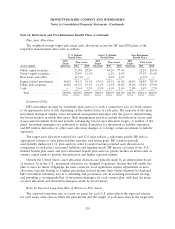

Expected asset class returns reflect the current yield on U.S. government bonds and risk premiums for

each asset class. Because HP’s investment policy is to employ primarily active investment managers who

seek to outperform the broader market, the asset class expected returns are adjusted to reflect the

expected additional returns net of fees.

HP closed the acquisition of EDS on August 26, 2008. Effective immediately before the close of

fiscal 2009, HP merged the assets of the HP and EDS U.S. pension plans. The expected return on the

plan assets, used in calculating the net benefit costs, is 7.6% for fiscal 2012, which reflects the result of

the most recent asset allocation study and is commensurate with the investment strategy for the merged

U.S. pension plan.

The approach used to arrive at the expected rate of return on assets for the non-U.S. plans reflects

the asset allocation policy of each plan and the expected country real returns for equity and fixed

income investments. On an annual basis, HP gathers empirical data from the local country subsidiaries

to determine expected long-term rates of return for equity and fixed income securities. HP then weights

these expected real rates of return based on country specific allocation mixes adjusted for inflation.

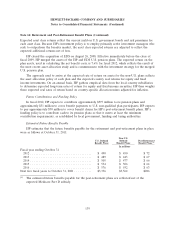

Future Contributions and Funding Policy

In fiscal 2012, HP expects to contribute approximately $597 million to its pension plans and

approximately $31 million to cover benefit payments to U.S. non-qualified plan participants. HP expects

to pay approximately $30 million to cover benefit claims for HP’s post-retirement benefit plans. HP’s

funding policy is to contribute cash to its pension plans so that it meets at least the minimum

contribution requirements, as established by local government, funding and taxing authorities.

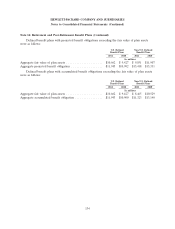

Estimated Future Benefits Payable

HP estimates that the future benefits payable for the retirement and post-retirement plans in place

were as follows at October 31, 2011:

Non-U.S.

U.S. Defined Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans(1)

In millions

Fiscal year ending October 31

2012 ................................... $ 490 $ 450 $ 72

2013 ................................... $ 489 $ 443 $ 67

2014 ................................... $ 505 $ 477 $ 66

2015 ................................... $ 534 $ 506 $ 64

2016 ................................... $ 576 $ 552 $ 63

Next five fiscal years to October 31, 2021 .......... $3,336 $3,562 $286

(1) The estimated future benefits payable for the post-retirement plans are reflected net of the

expected Medicare Part D subsidy.

139