HP 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

comprised of the $265 million net cost of British pound options bought to limit foreign exchange rate

risk. The increase was also as a result of higher interest expenses due to higher average debt balances,

the effect of which was partially offset by lower litigation costs and lower currency transaction losses.

Interest and other, net improved by $216 million in fiscal 2010. The improvement was driven

primarily by lower currency losses on balance sheet remeasurement items, lower interest expenses on

debt balances due to lower interest rates, and a value-added tax refund, the effect of which was

partially offset by an increase to our litigation accruals.

Provision for Taxes

Our effective tax rates were 21.2%, 20.2% and 18.6% in fiscal 2011, 2010 and 2009, respectively.

Our effective tax rate generally differs from the U.S. federal statutory rate of 35% due to favorable tax

rates associated with certain earnings from our operations in lower-tax jurisdictions throughout the

world. The jurisdictions with favorable tax rates that have the most significant effective tax rate impact

in the periods presented include Singapore, the Netherlands, China, Ireland and Puerto Rico. We plan

to reinvest some of the earnings of these jurisdictions indefinitely outside the United States and

therefore have not provided U.S. taxes on those indefinitely reinvested earnings.

The increase in the overall tax rate in fiscal 2011 was due primarily to nondeductible goodwill and

increases in valuation allowances. The increase in the overall tax rate in fiscal 2010 was due primarily

to a decrease in the income tax benefits related to foreign earnings.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and

further explanation of our provision for taxes, see Note 14 to the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference.

Segment Information

A description of the products and services, as well as financial data, for each segment can be

found in Note 19 to the Consolidated Financial Statements in Item 8, which is incorporated herein by

reference. We have realigned segment financial data for the fiscal years ended October 31, 2010 and

2009 to reflect changes in HP’s organizational structure that occurred at the beginning of the first

quarter of fiscal 2011. We describe these changes more fully in Note 19. We have presented the

business segments in this Annual Report on Form 10-K based on the distinct nature of various

businesses such as customer base, homogeneity of products and technology. The discussions below

include the results of each of our segments.

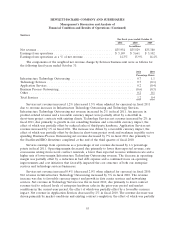

Personal Systems Group

For the fiscal years ended October 31

2011 2010 2009

In millions

Net revenue ........................................... $39,574 $40,741 $35,305

Earnings from operations ................................. $ 2,350 $ 2,032 $ 1,661

Earnings from operations as a % of net revenue ................ 5.9% 5.0% 4.7%

53