HP 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

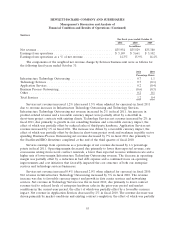

Net portfolio assets at October 31, 2011 increased 11.5% from October 31, 2010. The increase

resulted from higher levels of financing originations in fiscal 2011 and a favorable currency impact. The

overall reserve coverage ratio decreased as a percentage of the portfolio assets. HPFS funds its

operations mainly through a combination of intercompany debt and equity.

HPFS recorded net bad debt expenses of $60 million and $75 million in fiscal 2011 and fiscal 2010,

respectively.

Corporate Investments

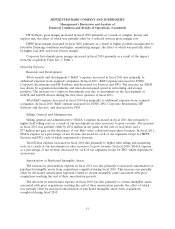

For the fiscal years ended October 31

2011 2010 2009

In millions

Net revenue ......................................... $ 322 $ 346 $ 191

Loss from operations ................................... $(1,616) $ (366) $ (300)

Loss from operations as a % of net revenue .................. (501.9)% (105.8)% (157.1)%

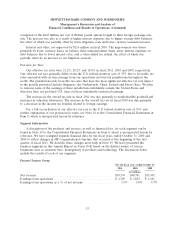

Net revenue in Corporate Investments in fiscal 2011 relates primarily to mobile devices associated

with the Palm acquisition, business intelligence solutions and licensing of HP technology to third

parties. In fiscal 2011, the revenue decrease was due primarily to lower business intelligence solutions

revenue, the effect of which was partially offset by revenue from webOS devices. Business intelligence

solutions revenue declined mainly due to lower revenue from consulting services.

Corporate Investments reported a higher loss from operations in fiscal 2011 due primarily to

$755 million of expenses for supplier-related obligations and sales incentive programs related to

winding down the webOS device business. The loss from operations in Corporate Investments was also

due to expenses carried in the segment associated with corporate development, global alliances and HP

Labs, which expenses increased from fiscal 2010 and were partially offset by a gain on the divestiture of

HP’s Halo video collaboration products business.

Net revenue in Corporate Investments in fiscal 2010 relates primarily to business intelligence

solutions and licensing of HP technology to third parties. The revenue increase in Corporate

Investments was also due to revenue resulting from the acquisition of Palm, which HP completed in

July 2010.

Corporate Investments reported a loss from operations in fiscal 2010 due primarily to the impact

from investments in research and product development. The earnings from operations in Corporate

Investments were also impacted by expenses carried in the segment associated with corporate

development, global alliances and HP Labs that declined from fiscal 2009.

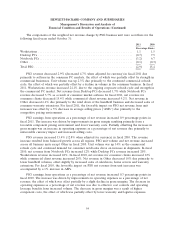

LIQUIDITY AND CAPITAL RESOURCES

Our cash balances are held in numerous locations throughout the world, with substantially all of

those amounts held outside of the United States. A majority of the amounts held outside of the United

States are generally utilized to support non-U.S. liquidity needs. Most of the amounts held outside of

the United States could be repatriated to the United States but, under current law, would be subject to

United States federal income taxes, less applicable foreign tax credits. Repatriation of some foreign

balances is restricted by local laws. We have provided for the U.S. federal tax liability on these amounts

for financial statement purposes, except for foreign earnings that are considered indefinitely reinvested

outside of the United States. Repatriation could result in additional U.S. federal income tax payments

61