HP 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

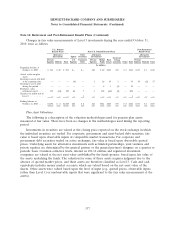

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

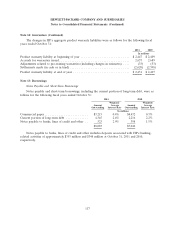

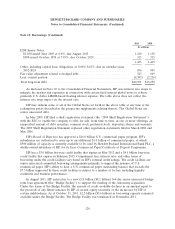

Note 15: Stockholders’ Equity (Continued)

3 million shares repurchased in transactions that were executed in fiscal 2009 but settled in fiscal 2010.

In fiscal 2009, HP completed share repurchases of approximately 120 million shares. Repurchases of

approximately 132 million shares were settled for $5.1 billion, which included approximately 14 million

shares repurchased in transactions that were executed in fiscal 2008 but settled in fiscal 2009. The

foregoing shares repurchased and settled in fiscal 2011, fiscal 2010 and fiscal 2009 were all open market

repurchase transactions.

In fiscal 2011, HP’s Board of Directors authorized an additional $10 billion for future share

repurchases. In fiscal 2010, HP’s Board of Directors authorized an additional $18.0 billion for future

share repurchases. In fiscal 2009, there was no additional authorization for future share repurchases by

HP’s Board of Directors. As of October 31, 2011, HP had remaining authorization of approximately

$10.8 billion for future share repurchases.

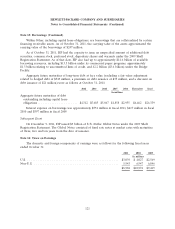

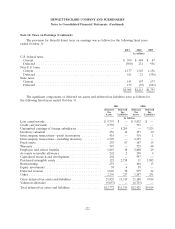

Comprehensive Income

The changes in the components of other comprehensive income, net of taxes, were as follows for

the following fiscal years ended October 31:

2011 2010 2009

In millions

Net earnings .............................................. $7,074 $8,761 $ 7,660

Net change in unrealized gains on available-for-sale securities:

Change in net unrealized gains with no tax effect in fiscal 2011, net of

tax of $9 million in fiscal 2010 and net of tax of $11 million in fiscal

2009 ................................................. 17 16 17

Net unrealized gains reclassified into earnings, with no tax effect ....... — — (1)

17 16 16

Net change in unrealized gains (losses) on cash flow hedges:

Unrealized (losses) gains recognized in OCI, net of tax benefit of

$86 million in fiscal 2011, net of tax of $119 million in fiscal 2010 and

net of tax benefit of $362 million in fiscal 2009 .................. (288) 250 (540)

Losses (gains) reclassified into income, net of tax benefit of $210 million

in fiscal 2011, net of tax of $149 million in fiscal 2010 and net of tax of

$187 million in fiscal 2009 ................................. 448 (282) (431)

160 (32) (971)

Net change in cumulative translation adjustment, net of tax of $20 million

in fiscal 2011, net of tax of $31 million in fiscal 2010 and net of tax of

$227 million in fiscal 2009 ................................... 46 28 304

Net change in unrealized components of defined benefit plans, net of tax

benefit of $229 million in fiscal 2011, $83 million in fiscal 2010 and

$905 million in fiscal 2009 ................................... 116 (602) (2,531)

Comprehensive income ...................................... $7,413 $8,171 $ 4,478

127