HP 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

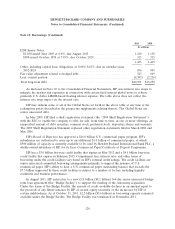

Note 13: Borrowings (Continued)

Within Other, including capital lease obligations, are borrowings that are collateralized by certain

financing receivable assets. As of October 31, 2011, the carrying value of the assets approximated the

carrying value of the borrowings of $247 million.

As of October 31, 2011, HP had the capacity to issue an unspecified amount of additional debt

securities, common stock, preferred stock, depositary shares and warrants under the 2009 Shelf

Registration Statement. As of that date, HP also had up to approximately $14.6 billion of available

borrowing resources, including $13.3 billion under its commercial paper programs, approximately

$1.3 billion relating to uncommitted lines of credit, and £2.2 billion ($3.6 billion) under the Bridge

Facility.

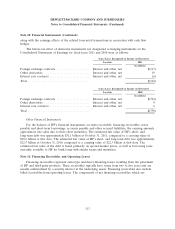

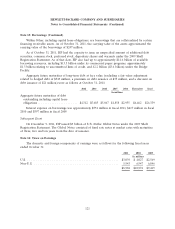

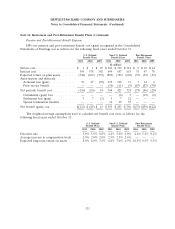

Aggregate future maturities of long-term debt at face value (excluding a fair value adjustment

related to hedged debt of $543 million, a premium on debt issuance of $35 million, and a discount on

debt issuance of $21 million) were as follows at October 31, 2011:

2012 2013 2014 2015 2016 Thereafter Total

In millions

Aggregate future maturities of debt

outstanding including capital lease

obligations ....................... $4,312 $5,685 $5,067 $1,858 $2,955 $6,462 $26,339

Interest expense on borrowings was approximately $551 million in fiscal 2011, $417 million in fiscal

2010 and $597 million in fiscal 2009.

Subsequent Event

On December 9, 2011, HP issued $3 billion of U.S. Dollar Global Notes under the 2009 Shelf

Registration Statement. The Global Notes consisted of fixed rate notes at market rates with maturities

of three, five and ten years from the date of issuance.

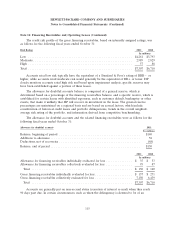

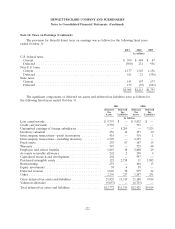

Note 14: Taxes on Earnings

The domestic and foreign components of earnings were as follows for the following fiscal years

ended October 31:

2011 2010 2009

In millions

U.S. .................................................... $3,039 $ 4,027 $2,569

Non-U.S. ................................................ 5,943 6,947 6,846

$8,982 $10,974 $9,415

121