HP 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 13: Borrowings (Continued)

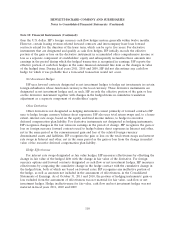

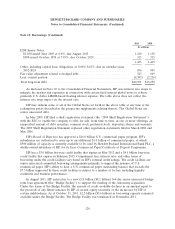

2011 2010

In millions

EDS Senior Notes

$1,100 issued June 2003 at 6.0%, due August 2013 ...................... 1,120 1,130

$300 issued October 1999 at 7.45%, due October 2029 .................... 315 315

1,435 1,445

Other, including capital lease obligations, at 0.60%-8.63%, due in calendar years

2012-2024 .................................................... 836 845

Fair value adjustment related to hedged debt ............................ 543 669

Less: current portion .............................................. (4,345) (2,216)

Total long-term debt .............................................. $22,551 $15,258

As disclosed in Note 10 to the Consolidated Financial Statements, HP uses interest rate swaps to

mitigate the market risk exposures in connection with certain fixed interest global notes to achieve

primarily U.S. dollar LIBOR-based floating interest expense. The table above does not reflect the

interest rate swap impact on the interest rate.

HP may redeem some or all of the Global Notes set forth in the above table at any time at the

redemption prices described in the prospectus supplements relating thereto. The Global Notes are

senior unsecured debt.

In May 2009, HP filed a shelf registration statement (the ‘‘2009 Shelf Registration Statement’’)

with the SEC to enable the company to offer for sale, from time to time, in one or more offerings, an

unspecified amount of debt securities, common stock, preferred stock, depositary shares and warrants.

The 2009 Shelf Registration Statement replaced other registration statements filed in March 2002 and

May 2006.

HP’s Board of Directors has approved a $16.0 billion U.S. commercial paper program. HP’s

subsidiaries are authorized to issue up to an additional $1.0 billion of commercial paper, of which

$500 million of capacity is currently available to be used by Hewlett-Packard International Bank PLC, a

wholly-owned subsidiary of HP, for its Euro Commercial Paper/Certificate of Deposit Programme.

HP has a $3.0 billion five-year credit facility that expires in May 2012 and a $4.5 billion four-year

credit facility that expires in February 2015. Commitment fees, interest rates and other terms of

borrowing under the credit facilities vary based on HP’s external credit ratings. The credit facilities are

senior unsecured committed borrowing arrangements primarily to support the issuance of U.S.

commercial paper. HP’s ability to have a U.S. commercial paper outstanding balance that exceeds the

$7.5 billion supported by these credit facilities is subject to a number of factors, including liquidity

conditions and business performance.

In August 2011, HP entered in to a new £5.0 billion ($8.1 billion) 364-day senior unsecured bridge

term loan agreement (the ‘‘Bridge Facility’’) to support the funding of the Autonomy acquisition.

Under the terms of the Bridge Facility, the amount of credit available declines in an amount equal to

the proceeds of any future issuance by HP of certain equity securities or the incurrence by HP of

certain indebtedness. As of October 31, 2011, £2.2 billion ($3.6 billion) in borrowing capacity remained

available under the Bridge Facility. The Bridge Facility was terminated in November 2011.

120