HP 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

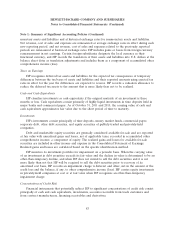

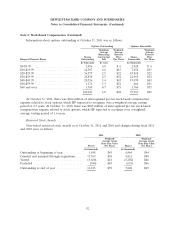

Note 2: Stock-Based Compensation (Continued)

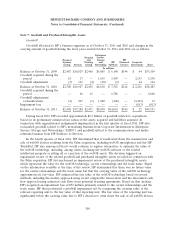

The details of restricted stock awards granted and assumed through acquisitions were as follows:

2011 2010

Weighted- Weighted-

Average Grant Average Grant

Date Fair Date Fair

Value Value

Shares Per Share Shares Per Share

In thousands In thousands

Restricted stock ........................ 335 $42 1,543 $48

Restricted stock units .................... 17,234 $38 3,278 $48

17,569 $38 4,821 $48

In fiscal 2011, there were no restricted stock units assumed through acquisitions. In fiscal 2010,

approximately 3 million restricted stock units with a weighted-average grant date fair value of $48 per

share were assumed through acquisitions.

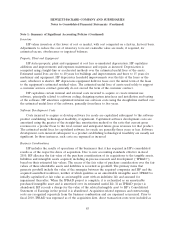

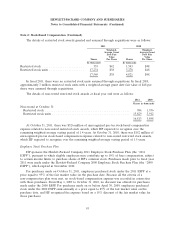

The details of non-vested restricted stock awards at fiscal year end were as follows:

2011 2010

Shares in thousands

Non-vested at October 31:

Restricted stock ................................................ 984 1,936

Restricted stock units ............................................ 15,829 3,912

16,813 5,848

At October 31, 2011, there was $526 million of unrecognized pre-tax stock-based compensation

expense related to non-vested restricted stock awards, which HP expected to recognize over the

remaining weighted-average vesting period of 1.4 years. At October 31, 2010, there was $152 million of

unrecognized pre-tax stock-based compensation expense related to non-vested restricted stock awards,

which HP expected to recognize over the remaining weighted-average vesting period of 1.5 years.

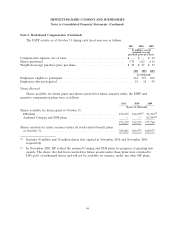

Employee Stock Purchase Plan

HP sponsors the Hewlett-Packard Company 2011 Employee Stock Purchase Plan (the ‘‘2011

ESPP’’), pursuant to which eligible employees may contribute up to 10% of base compensation, subject

to certain income limits, to purchase shares of HP’s common stock. Purchases made prior to fiscal year

2011 were made under the Hewlett-Packard Company 2000 Employee Stock Purchase Plan (the ‘‘2000

ESPP’’), which expired in November 2010.

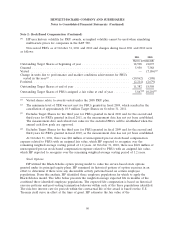

For purchases made on October 31, 2011, employees purchased stock under the 2011 ESPP at a

price equal to 95% of the fair market value on the purchase date. Because all the criteria of a

non-compensatory plan were met, no stock-based compensation expense was recorded in connection

with those purchases. From May 1, 2009 to October 31, 2010, no discount was offered for purchases

made under the 2000 ESPP. For purchases made on or before April 30, 2009, employees purchased

stock under the 2000 ESPP semi-annually at a price equal to 85% of the fair market value on the

purchase date, and HP recognized the expense based on a 15% discount of the fair market value for

those purchases.

93