HP 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

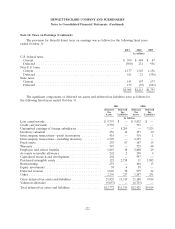

Note 14: Taxes on Earnings (Continued)

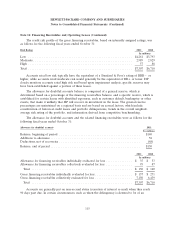

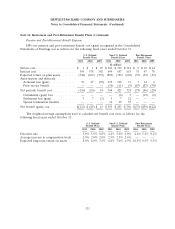

The differences between the U.S. federal statutory income tax rate and HP’s effective tax rate

were as follows for the following fiscal years ended October 31:

2011 2010 2009

U.S. federal statutory income tax rate .............................. 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit ........................ 0.5 1.3 0.9

Lower rates in other jurisdictions, net .............................. (24.0) (18.3) (12.2)

Research and development credit ................................. (0.6) (0.1) (0.5)

Foreign net operating loss ...................................... — — (4.1)

Valuation allowance ........................................... 5.2 0.8 (0.6)

Accrued taxes due to post-acquisition integration ..................... — — 0.6

Nondeductible goodwill ........................................ 3.4 — —

Other, net .................................................. 1.7 1.5 (0.5)

21.2% 20.2% 18.6%

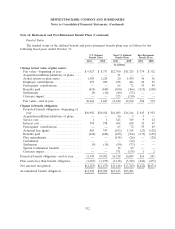

The jurisdictions with favorable tax rates that have the most significant effective tax rate impact in

the periods presented include Singapore, the Netherlands, China, Ireland and Puerto Rico. HP plans to

reinvest some of the earnings of these jurisdictions indefinitely outside the United States and therefore

has not provided U.S. taxes on those indefinitely reinvested earnings.

In fiscal 2011, HP recorded $325 million of net income tax charges related to items unique to the

year. These amounts included $468 million of tax charges for increases to foreign and state valuation

allowances, offset by $78 million of income tax benefits for adjustments to prior year foreign income

tax accruals, $63 million of income tax benefits for uncertain tax position reserve adjustments and

settlement of tax audit matters, and $2 million of tax benefits associated with miscellaneous prior

period items.

In fiscal 2010, HP recorded $26 million of net income tax benefits related to items unique to the

year. These amounts included adjustments to prior year foreign income tax accruals and credits,

settlement of tax audit matters, valuation allowance adjustments and other miscellaneous discrete items.

In fiscal 2009, HP recorded $547 million of net income tax benefits related to items unique to the

year. The recorded amounts included $383 million of income tax benefits attributable to net deferred

tax assets for foreign net operating loss carryovers arising pursuant to internal restructuring

transactions. Also included were a net tax benefit of $154 million for the adjustment to estimated fiscal

2008 tax accruals upon filing the 2008 income tax returns, a $60 million income tax benefit for

valuation allowance reversals for state and foreign net operating losses, and other miscellaneous items

that resulted in a net tax charge of $50 million.

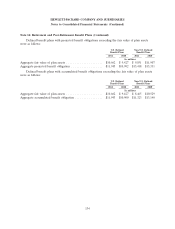

As a result of certain employment actions and capital investments HP has undertaken, income

from manufacturing and services in certain countries is subject to reduced tax rates, and in some cases

is wholly exempt from taxes, through 2024. The gross income tax benefits attributable to these actions

and investments were estimated to be $1.3 billion (approximately $0.62 basic earnings per share) in

fiscal year 2011, $966 million (approximately $0.41 basic earnings per share) in fiscal year 2010 and

$853 million (approximately $0.35 basic earnings per share) in fiscal year 2009. The gross income tax

benefits were offset partially by accruals of U.S. income taxes on undistributed earnings, among other

factors.

124