HP 2011 Annual Report Download - page 166

Download and view the complete annual report

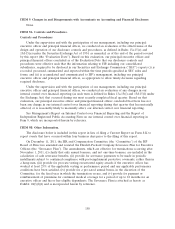

Please find page 166 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

ITEM 9A. Controls and Procedures.

Controls and Procedures

Under the supervision and with the participation of our management, including our principal

executive officer and principal financial officer, we conducted an evaluation of the effectiveness of the

design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended, as of the end of the period covered

by this report (the ‘‘Evaluation Date’’). Based on this evaluation, our principal executive officer and

principal financial officer concluded as of the Evaluation Date that our disclosure controls and

procedures were effective such that the information relating to HP, including our consolidated

subsidiaries, required to be disclosed in our Securities and Exchange Commission (‘‘SEC’’) reports (i) is

recorded, processed, summarized and reported within the time periods specified in SEC rules and

forms, and (ii) is accumulated and communicated to HP’s management, including our principal

executive officer and principal financial officer, as appropriate to allow timely decisions regarding

required disclosure.

Under the supervision and with the participation of our management, including our principal

executive officer and principal financial officer, we conducted an evaluation of any changes in our

internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under

the Exchange Act) that occurred during our most recently completed fiscal quarter. Based on that

evaluation, our principal executive officer and principal financial officer concluded that there has not

been any change in our internal control over financial reporting during that quarter that has materially

affected, or is reasonably likely to materially affect, our internal control over financial reporting.

See Management’s Report on Internal Control over Financial Reporting and the Report of

Independent Registered Public Accounting Firm on our internal control over financial reporting in

Item 8, which are incorporated herein by reference.

ITEM 9B. Other Information.

The disclosure below is included in this report in lieu of filing a Current Report on Form 8-K to

report events that have occurred within four business days prior to the filing of this report.

On December 11, 2011, the HR and Compensation Committee (the ‘‘Committee’’) of the HP

Board of Directors amended and restated the Hewlett-Packard Company Severance Plan for Executive

Officers (the ‘‘Severance Plan’’). The amendments, which are effective for terminations occurring after

November 1, 2011, (i) clarify that only annual bonuses, and not one-time bonuses, are included in the

calculation of cash severance benefits, (ii) provide for severance payments to be made in periodic

installments subject to continued compliance with post-employment protective covenants, rather than in

a lump sum, (iii) provide for pro-rata vesting on unvested equity awards if the executive officer has

worked at least 25% of the applicable vesting or performance period and any applicable performance

conditions have been satisfied, (iv) provide for a pro-rated annual bonus, in the discretion of the

Committee, for the fiscal year in which the termination occurs, and (v) provide for payment or

reimbursement of premiums for continued medical coverage for a period of up to 18 months for an

executive officer and his or her eligible dependents. The Severance Plan is attached as hereto as

Exhibit 10(f)(f)(f) and is incorporated herein by reference.

158