HP 2011 Annual Report Download - page 58

Download and view the complete annual report

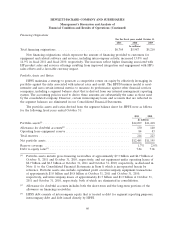

Please find page 58 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Services gross margin decreased in fiscal 2011 due primarily to lower than expected revenue, rate

concessions arising from recent contract renewals, a lower than expected resource utilization rate and a

higher mix of lower-margin Infrastructure Technology Outsourcing revenue. The decrease was partially

offset by a continued focus on operating improvements and cost initiatives that favorably impacted the

cost structure of both our enterprise services and technology services businesses.

IPG gross margin declined in fiscal 2011 due primarily to increased logistics costs and supply chain

constraints in LaserJet printer engines and toner as a result of the earthquake and tsunami in Japan,

and an unfavorable currency impact driven primarily by the strength of the yen. In addition, IPG gross

margin declined due to a continuing mix shift in Consumer Hardware and Commercial Hardware

toward lower price point products, coupled with a lower mix of supplies revenue. These effects were

partially offset by reductions in IPG’s cost structure as a result of continued efforts to optimize our

supply chain.

ESSN gross margin increased in fiscal 2011 primarily as a result of lower product costs and a

higher mix of networking products, the effect of which was partially offset by price declines as a result

of competitive pressure.

HP Software gross margin decreased in fiscal 2011 due primarily to rate declines in licenses and

services.

HPFS gross margin decreased in fiscal 2011 due primarily to lower portfolio margins from a higher

mix of operating leases, the effect of which was partially offset by lower bad debt expense as a

percentage of revenue and higher margins on lease extensions and buyouts.

Corporate Investments gross margin decreased in fiscal 2011 primarily as a result of the impact of

the wind down of the webOS device business, which resulted in expenses for supplier-related

obligations, sales incentive programs and inventory write downs.

Fiscal 2010

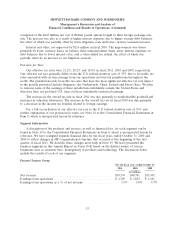

In fiscal 2010, total HP gross margin increased by 0.3 percentage points. The increase was a result

of an increased mix in networking products and rate increase in Services, the effect of which was

partially offset by strong revenue growth in personal computers and printer hardware that have lower

gross margins.

PSG gross margin declined in fiscal 2010 primarily as a result of higher component costs, the effect

of which was partially offset by lower warranty and logistics expenses.

Services gross margin increased in fiscal 2010 due primarily to the continued focus on operating

improvements, including delivery efficiencies and cost controls in our technology services business and

acquisition synergies related to the acquisition of Electronic Data Systems Corporation (‘‘EDS’’).

IPG gross margin declined in fiscal 2010 due primarily to a higher mix of hardware and a

correspondingly lower mix of supplies, the effect of which was partially offset by cost savings associated

with our ongoing efforts to optimize our supply chain.

ESSN gross margin increased in fiscal 2010 due primarily to lower product costs and strong

volume, the effect of which was partially offset by a product mix shift resulting from the strength in

Industry Standard Servers (‘‘ISS’’), which has lower gross margins.

50