HP 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

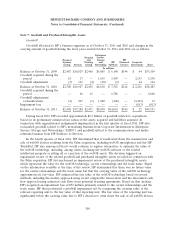

Note 7: Goodwill and Purchased Intangible Assets (Continued)

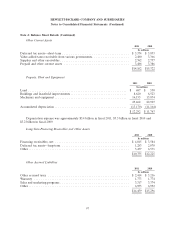

At October 31, 2011 and at October 31, 2010, $4.7 billion and $2.5 billion, respectively, of

intangible assets reached the end of their amortizable periods. The tables above reflect the elimination

of the cost and accumulated amortization of such assets.

HP also performed its annual impairment test for all other reporting units and for the

indefinite-lived Compaq trade name. As a result of the analysis, HP concluded that no impairment of

goodwill existed as of August 1, 2011, apart from the impairment in the webOS device business

discussed above. There was no impairment of goodwill and indefinite-lived intangible assets as of

August 1, 2010. However, future impairment tests could result in a charge to earnings. The excess of

fair value over carrying value for the indefinite-lived Compaq trade name is approximately $144 million

as of August 1, 2011, the annual testing date. In order to evaluate the sensitivity of the fair value

calculation, we applied a hypothetical 10% decrease to the fair value of the intangible, which resulted

in an excess of fair value over carrying value of approximately $13 million. In addition, if a future

change in HP’s branding strategy resulted in the reclassification of the Compaq trade name from an

indefinite-lived intangible to a definite-lived intangible, there would be a significant decrease in the fair

value of the asset.

HP will continue to evaluate goodwill and indefinite-lived intangibles on an annual basis as of the

beginning of its fourth fiscal quarter, or whenever events, changes in circumstances or changes in

management’s business strategy indicate that there may be a potential indicator of impairment.

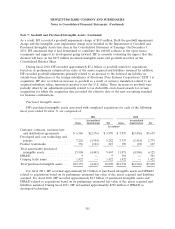

The finite-lived purchased intangible assets consist of customer contracts, customer lists and

distribution agreements, which have weighted-average useful lives of 8 years, and developed and core

technology, patents and product trademarks, which have weighted-average useful lives of 7 years.

Estimated future amortization expense related to finite-lived purchased intangible assets at

October 31, 2011 is as follows:

Fiscal year: In millions

2012 ................................................................ $1,885

2013 ................................................................ 1,732

2014 ................................................................ 1,410

2015 ................................................................ 1,237

2016 ................................................................ 1,073

Thereafter ............................................................ 2,130

Total ................................................................ $9,467

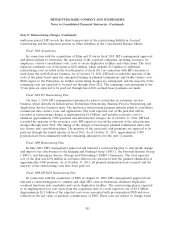

Note 8: Restructuring Charges

HP records restructuring charges associated with management-approved restructuring plans to

either reorganize one or more of HP’s business segments, or to remove duplicative headcount and

infrastructure associated with one or more business acquisitions. Restructuring charges can include

severance costs to eliminate a specified number of employee positions, infrastructure charges to vacate

facilities and consolidate operations, and contract cancellation cost. Restructuring charges are recorded

based upon planned employee termination dates and site closure and consolidation plans. The timing

of associated cash payments is dependent upon the type of restructuring charge and can extend over a

102