HP 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

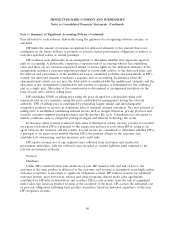

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

Inventory

HP values inventory at the lower of cost or market, with cost computed on a first-in, first-out basis.

Adjustments to reduce the cost of inventory to its net realizable value are made, if required, for

estimated excess, obsolescence or impaired balances.

Property, Plant and Equipment

HP states property, plant and equipment at cost less accumulated depreciation. HP capitalizes

additions and improvements and expenses maintenance and repairs as incurred. Depreciation is

computed using straight-line or accelerated methods over the estimated useful lives of the assets.

Estimated useful lives are five to 40 years for buildings and improvements and three to 15 years for

machinery and equipment. HP depreciates leasehold improvements over the life of the lease or the

asset, whichever is shorter. HP depreciates equipment held for lease over the initial term of the lease

to the equipment’s estimated residual value. The estimated useful lives of assets used solely to support

a customer services contract generally do not exceed the term of the customer contract.

HP capitalizes certain internal and external costs incurred to acquire or create internal use

software, principally related to software coding, designing system interfaces and installation and testing

of the software. HP amortizes capitalized internal use software costs using the straight-line method over

the estimated useful lives of the software, generally from three to five years.

Software Development Costs

Costs incurred to acquire or develop software for resale are capitalized subsequent to the software

product establishing technological feasibility, if significant. Capitalized software development costs are

amortized using the greater of the straight-line amortization method or the ratio that current gross

revenues for a product bear to the total current and anticipated future gross revenues for that product.

The estimated useful lives for capitalized software for resale are generally three years or less. Software

development costs incurred subsequent to a product establishing technological feasibility are usually not

significant. In those instances, such costs are expensed as incurred.

Business Combinations

HP includes the results of operations of the businesses that it has acquired in HP’s consolidated

results as of the respective dates of acquisition. Due to new accounting standards effective in fiscal

2010, HP allocates the fair value of the purchase consideration of its acquisitions to the tangible assets,

liabilities and intangible assets acquired, including in-process research and development (‘‘IPR&D’’),

based on their estimated fair values. The excess of the fair value of purchase consideration over the fair

values of these identifiable assets and liabilities is recorded as goodwill. The primary items that

generate goodwill include the value of the synergies between the acquired companies and HP and the

acquired assembled workforce, neither of which qualifies as an amortizable intangible asset. IPR&D is

initially capitalized at fair value as an intangible asset with an indefinite life and assessed for

impairment thereafter. When the IPR&D project is complete, it is reclassified as an amortizable

purchased intangible asset and is amortized over its estimated useful life. If an IPR&D project is

abandoned, HP records a charge for the value of the related intangible asset to HP’s Consolidated

Statement of Earnings in the period it is abandoned. Acquisition-related expenses and restructuring

costs are recognized separately from the business combination and are expensed as incurred. Prior to

fiscal 2010, IPR&D was expensed as of the acquisition date, direct transaction costs were included as

85