HP 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

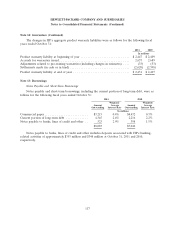

Note 11: Financing Receivables and Operating Leases (Continued)

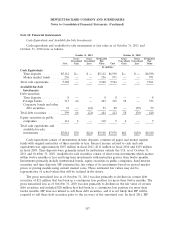

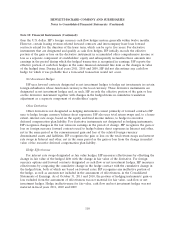

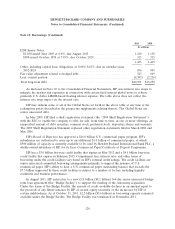

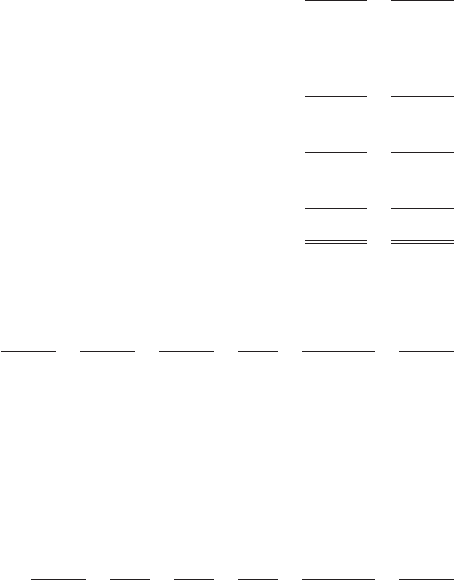

included in financing receivables and long-term financing receivables and other assets, were as follows

for the following fiscal years ended October 31:

2011 2010

In millions

Minimum lease payments receivable ................................... $7,721 $ 7,094

Unguaranteed residual value ........................................ 233 212

Unearned income ................................................ (647) (596)

Financing receivables, gross ......................................... 7,307 6,710

Allowance for doubtful accounts ...................................... (130) (140)

Financing receivables, net ........................................... 7,177 6,570

Less current portion ............................................... (3,162) (2,986)

Amounts due after one year, net ..................................... $4,015 $ 3,584

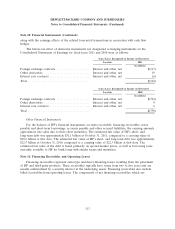

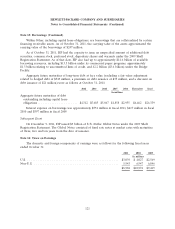

As of October 31, 2011, scheduled maturities of HP’s minimum lease payments receivable were as

follows for the following fiscal years ended October 31:

2012 2013 2014 2015 Thereafter Total

Scheduled maturities of minimum lease payments

receivable ........................... $3,518 $2,256 $1,257 $517 $173 $7,721

Equipment leased to customers under operating leases was $4.0 billion at October 31, 2011 and

$3.5 billion at October 31, 2010 and is included in machinery and equipment. Accumulated

depreciation on equipment under lease was $1.3 billion at October 31, 2011 and $1.0 billion at

October 31, 2010. As of October 31, 2011, minimum future rentals on non-cancelable operating leases

related to leased equipment were as follows for the following fiscal years ended October 31:

2012 2013 2014 2015 Thereafter Total

Minimum future rentals on non-cancelable operating

leases ................................. $1,273 $801 $414 $152 $42 $2,682

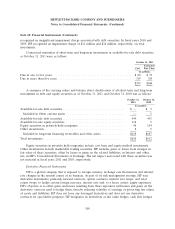

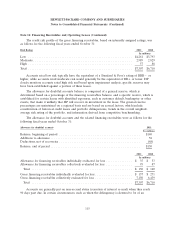

Due to the homogenous nature of the leasing transactions, HP manages its financing receivables

on an aggregate basis when assessing and monitoring credit risk. Credit risk is generally diversified due

to the large number of entities comprising HP’s customer base and their dispersion across many

different industries and geographical regions. The credit quality of an obligor is evaluated at lease

inception and monitored over the term of a transaction. Risk ratings are assigned to each lease based

on the creditworthiness of the obligor and other variables that augment or diminish the inherent credit

risk of a particular transaction. Such variables include the underlying value and liquidity of the

collateral, the essential use of the equipment, the term of the lease, and the inclusion of guarantees,

letters of credit, security deposits or other credit enhancements.

114