HP 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

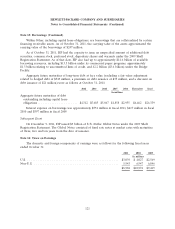

Note 14: Taxes on Earnings (Continued)

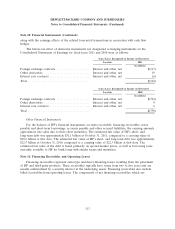

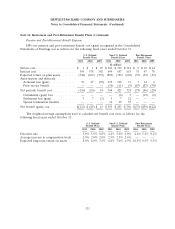

The provision for (benefit from) taxes on earnings was as follows for the following fiscal years

ended October 31:

2011 2010 2009

In millions

U.S. federal taxes:

Current ................................................. $ 390 $ 484 $ 47

Deferred ................................................ (590) 231 956

Non-U.S. taxes:

Current ................................................. 1,177 1,345 1,156

Deferred ................................................ 611 21 (356)

State taxes:

Current ................................................. 141 187 173

Deferred ................................................ 179 (55) (221)

$1,908 $2,213 $1,755

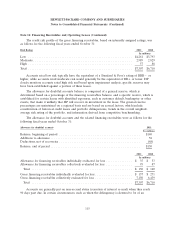

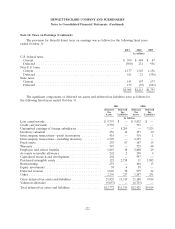

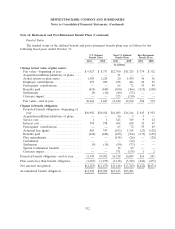

The significant components of deferred tax assets and deferred tax liabilities were as follows for

the following fiscal years ended October 31:

2011 2010

Deferred Deferred Deferred Deferred

Tax Tax Ta x Ta x

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards ................................ $ 9,793 $ — $ 9,832 $ —

Credit carryforwards .............................. 2,739 — 733 —

Unremitted earnings of foreign subsidiaries .............. — 8,209 — 7,529

Inventory valuation ............................... 236 12 153 10

Intercompany transactions—profit in inventory ........... 418 — 514 1

Intercompany transactions—excluding inventory .......... 1,529 — 2,339 —

Fixed assets ..................................... 255 63 163 15

Warranty ....................................... 747 — 723 48

Employee and retiree benefits ....................... 1,819 18 2,800 29

Accounts receivable allowance ....................... 262 2 290 9

Capitalized research and development .................. 294 — 597 —

Purchased intangible assets .......................... 125 2,738 11 1,885

Restructuring .................................... 233 — 404 13

Equity investments ................................ 58 6 59 —

Deferred revenue ................................ 1,025 38 975 24

Other ......................................... 2,296 233 1,587 251

Gross deferred tax assets and liabilities ................. 21,829 11,319 21,180 9,814

Valuation allowance ............................... (9,057) — (8,755) —

Total deferred tax assets and liabilities ................. $12,772 $11,319 $12,425 $9,814

122