HP 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 14: Taxes on Earnings (Continued)

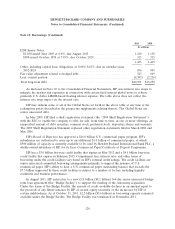

HP is subject to income tax in the United States and approximately 80 foreign countries and is

subject to routine corporate income tax audits in many of these jurisdictions. In addition, HP is subject

to numerous ongoing audits by state and foreign tax authorities. The IRS began an audit of HP’s 2008

income tax returns in 2010 and began its audit of HP’s 2009 income tax returns during 2011. HP has

received from the IRS Notices of Deficiency for its fiscal 1999, 2000, 2003, 2004 and 2005 tax years,

and Revenue Agent’s Reports (‘‘RAR’’) for its fiscal 2001, 2002, 2006 and 2007 tax years. The proposed

IRS adjustments for these tax years would, if sustained, reduce the benefits of tax refund claims HP has

filed for net operating loss carrybacks to earlier fiscal years and tax credit carryforwards to subsequent

years by approximately $557 million. HP has filed petitions with the United States Tax Court regarding

certain proposed IRS adjustments regarding tax years 1999 through 2003 and is continuing to contest

additional adjustments proposed by the IRS for other tax years. HP believes that it has provided

adequate reserves for any tax deficiencies or reductions in tax benefits that could result from the IRS

actions. With respect to major foreign and state tax jurisdictions, HP is no longer subject to tax

authority examinations for years prior to 1999. HP believes that adequate accruals have been provided

for all open tax years.

Tax years of EDS through 2002 have been audited by the IRS, and all proposed adjustments have

been resolved. The IRS is currently auditing EDS’s tax years 2007 and the short period ended

August 26, 2008. EDS has received RAR’s for exam years 2003, 2004, 2005 and 2006, proposing total

tax deficiencies of $110 million, including $30 million of reduction in carrybacks to prior years. HP is

contesting certain issues and believes it has provided adequate reserves for any tax deficiencies or

reductions in tax benefit that could result from the IRS actions.

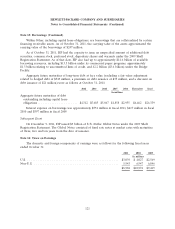

HP has not provided for U.S. federal income and foreign withholding taxes on $29.1 billion of

undistributed earnings from non-U.S. operations as of October 31, 2011 because HP intends to reinvest

such earnings indefinitely outside of the United States. If HP were to distribute these earnings, foreign

tax credits may become available under current law to reduce the resulting U.S. income tax liability.

Determination of the amount of unrecognized deferred tax liability related to these earnings is not

practicable. HP will remit non-indefinitely reinvested earnings of its non-US subsidiaries for which

deferred U.S. federal and withholding taxes have been provided where excess cash has accumulated and

it determines that it is advantageous for business operations, tax or cash management reasons.

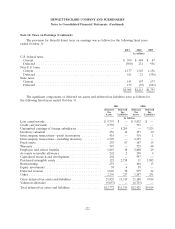

Note 15: Stockholders’ Equity

Dividends

The stockholders of HP common stock are entitled to receive dividends when and as declared by

HP’s Board of Directors. Dividends are paid quarterly. Dividends declared were $0.40 per common

share in fiscal 2011 and $0.32 per common share in each of fiscal 2010 and 2009.

Share Repurchase Program

HP’s share repurchase program authorizes both open market and private repurchase transactions.

In fiscal 2011, HP executed share repurchases of 259 million shares. Repurchases of 262 million shares

were settled for $10.1 billion, which included 4 million shares repurchased in transactions that were

executed in fiscal 2010 but settled in fiscal 2011. HP had no shares repurchased in the fourth quarter of

fiscal 2011 that will be settled in the next fiscal year. In fiscal 2010, HP executed share repurchases of

241 million shares. Repurchases of 240 million shares were settled for $11.0 billion, which included

126