GNC 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

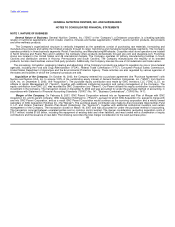

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

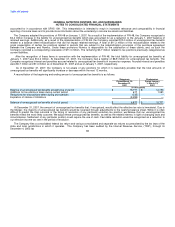

basis in the states in which it conducts business. The Company filed in a consistent manner for the year ended December 31, 2006 and 2005.

The Company adopted the provisions of FIN 48 on January 1, 2007. As a result of the implementation, the Company recognized an

adjustment of $0.4 million to retained earnings for the liability for unrecognized income tax benefits, net of the deferred tax effect. It is the

Company's policy to recognize interest and penalties related to uncertain tax positions as a component of income tax expense. See Note 5 for

additional information regarding the change in unrecognized tax benefits.

Self-Insurance. The Company has procured insurance for such areas as: (1) general liability; (2) product liability; (3) directors and officers

liability; (4) property insurance; and (5) ocean marine insurance. The Company is self-insured for such areas as: (1) medical benefits; (2)

worker's compensation coverage in the State of New York with a stop loss of $250,000; (3) physical damage to the Company's tractors, trailers

and fleet vehicles for field personnel use; and (4) physical damages that may occur at the corporate store locations. The Company is not

insured for certain property and casualty risks due to the frequency and severity of a loss, the cost of insurance and the overall risk analysis.

The Company's associated liability for this self-insurance was not significant as of December 31, 2007 and 2006. Prior to the Acquisition, GNCI

was included as an insured under several of Numico's global insurance policies.

The Company carries product liability insurance with a retention of $2.0 million per claim with an aggregate cap on retained losses of

$10.0 million. The Company carries general liability insurance with retention of $110,000 per claim with an aggregate cap on retained losses of

$600,000. The majority of the Company's workers' compensation and auto insurance are in a deductible/retrospective plan. The Company

reimburses the insurance company for the workers compensation and auto liability claims, subject to a $250,000 and $100,000 loss limit per

claim, respectively.

As part of the medical benefits program, the Company contracts with national service providers to provide benefits to its employees for all

medical, dental, vision and prescription drug services. The Company then reimburses these service providers as claims are processed from

Company employees. The Company maintains a specific stop loss provision of $250,000 per individual per plan year with a maximum lifetime

benefit limit of $2.0 million per individual. The Company has no additional liability once a participant exceeds the $2.0 million ceiling. The

Company's liability for medical claims is included as a component of accrued benefits in the "Accrued Payroll and Related Liabilities" footnote

and was $1.9 million and $2.4 million as of December 31, 2007 and 2006, respectively.

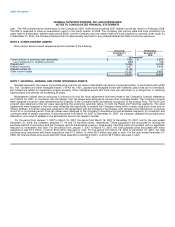

Stock Compensation. The Company adopted SFAS No. 123 (R) effective January 1, 2006. The Company selected the modified

prospective method, which does not require adjustment to prior period financial statements and measures expected future compensation cost

for stock-based awards at fair value on grant date. The Company utilizes the Black-Scholes model to calculate the fair value of options under

SFAS No. 123 (R), which is consistent with disclosures previously included in prior year financial statements under SFAS No. 123 "Accounting

for Stock-Based Compensation", ("SFAS 123"). The resulting compensation cost is recognized in the Company's financial statements over the

option vesting period.

Prior to the adoption of SFAS No. 123(R) and as permitted under SFAS 123 the Company measured compensation expense related to

stock options in accordance with APB No. 25 and related interpretations which use the intrinsic value method. If compensation expense were

determined based on the estimated fair value of options granted, consistent with the fair market value method in SFAS 123, its net income for

the year ended December 31, 2005 would be reduced to the pro forma amounts indicated in our "Stock-Based Compensation Plans" note.

Foreign Currency. For all foreign operations, the functional currency is the local currency. In accordance with SFAS No. 52, "Foreign

Currency Translation", assets and liabilities of those operations, denominated in foreign currencies, are translated into U.S. dollars using

period-end exchange rates, and income and expenses are translated using the average exchange rates for the reporting period. At

December 31, 2007 and 2006, the accumulated foreign currency gain amount was $2.7 million and $1.3

77