GNC 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

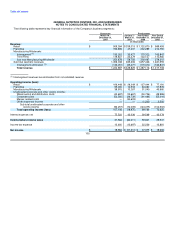

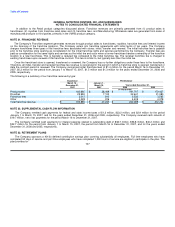

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

settlement contemplates a maximum total payment by the Company of $1.9 million if all potential claimants opt in. Based on the number of

actual opt-ins, the total amount paid in the third quarter of 2007 to the class is approximately $0.1 million. In addition, the Company paid the

plaintiffs counsel and agreed amount of $0.7 million for attorney's fees following approval by the court of the settlement. On July 23, 2007, the

court approved the settlement of claims as fair, reasonable, and adequate and entered its Order of Approval. The total amount paid to the class

approximated $0.1 million. Final Judgment was entered by the Court on December 18, 2007 disposing of the claims of the opt-in plaintiffs.

California Wage and Break Claim. On April 24, 2007, Kristin Casarez and Tyler Goodell filed a lawsuit against the Company in the Superior

Court of the State of California for the County of Orange. The Company removed the lawsuit to the United States District Court for the Central

district of California. Plaintiffs purport to bring the action on their own behalf, on behalf of a class of all current and former non-exempt

employees of GNC throughout the State of California employed on or after August 24, 2004, and as private attorney general on behalf of the

general public. Plaintiffs allege that they and members of the putative class were not provided all of the rest periods and meal periods to which

they were entitled under California law, and further allege that GNC failed to pay them split shift and overtime compensation to which they were

entitled to under California law. We intend to vigorously oppose class certification. Based on the information available to the Company at the

present time, they believe that this matter will not have a material adverse effect upon their business or financial condition.

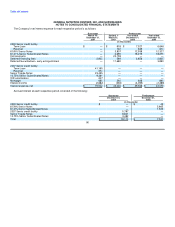

Commitments

The Company maintains certain purchase commitments with various vendors to ensure its operational needs are fulfilled of approximately

$35.8 million. The future purchase commitments consisted of $10.0 million of advertising and inventory commitments, $13.8 million

management services agreement and bank fees and $12.0 million related to future litigation costs. Other commitments related to the

Company's business operations cover varying periods of time and are not significant. All of these commitments are expected to be fulfilled with

no adverse consequences to the Company's operations or financial condition.

Contingencies

Due to the nature of the Company's business operations having a presence in multiple taxing jurisdictions, the Company periodically

receives inquiries and/or audits from various state and local taxing authorities. Any probable and reasonably estimated liabilities that may arise

from these inquiries have been accrued and reflected in the accompanying financial statements. In conjunction with the Acquisition by Apollo

Funds V, certain other contingencies will be indemnified by Numico. These indemnifications include certain legal costs associated with certain

identified cases as well as any tax costs, including audit settlements, that would be for liabilities incurred prior to December 5, 2003.

NOTE 18. STOCKHOLDER'S EQUITY

At December 31, 2007 there were 100 shares of Common Stock, par value $.01 per share, outstanding. All of our outstanding stock was

owned by our Parent at December 31, 2007.

NOTE 19. STOCK-BASED COMPENSATION PLANS

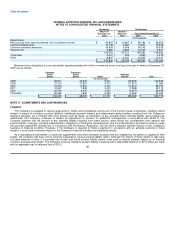

Stock Options

The Company adopted SFAS No. 123(R), effective January 1, 2006. The Company selected the modified prospective method, which does

not require adjustment to prior period financial statements and measures expected future compensation cost for stock-based awards at fair

value on grant date. The Company utilizes the Black-Scholes model to calculate the fair value of options under SFAS 123(R), which is

consistent with disclosures previously included in prior year financial statements under SFAS 123. The resulting compensation cost is

recognized in the Company's financial statements over the option vesting period. As of the date of adoption of SFAS 123(R), the net

unrecognized compensation 100