GNC 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

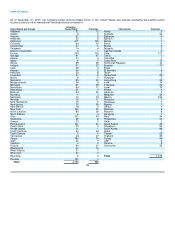

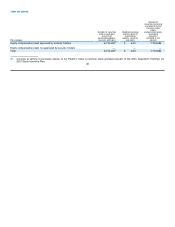

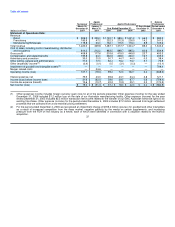

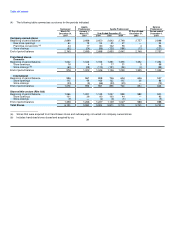

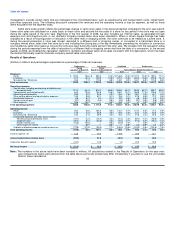

ITEM 6. SELECTED FINANCIAL DATA.

The selected consolidated financial data presented below as of and for the period March 16 to December 31, 2007, for the period

January 1, 2007 to March 15, 2007, and for the years ended December 31, 2006 and 2005 are derived from our audited consolidated financial

statements and their notes included in this report. The selected consolidated financial data presented below and for the year ended

December 31, 2004, the 27 days ended December 31, 2003 and the period from January 1, 2003 to December 4, 2003 are derived from our

audited consolidated financial statements and their notes, which are not included in this report. The selected consolidated financial data as of

and for the years then ended December 31, 2006, 2005, and 2004 and as of December 31, 2003 and for the 27 days then ended represent the

period during which General Nutrition Centers, Inc. was owned by Apollo. The selected consolidated financial data as of and for the period from

January 1, 2003 to December 4, 2003 represent the period during which General Nutrition Companies, Inc. was owned by Numico.

On December 5, 2003, we acquired 100% of the outstanding equity interests of General Nutrition Companies, Inc. from Numico in a

business combination accounted for under the purchase method of accounting. The selected consolidated financial data for the period from

January 1, 2003 to December 4, 2003 represent the period in 2003 that General Nutrition Companies, Inc. was owned by Numico. The selected

consolidated financial data for the 27 days ended December 31, 2003 represent the period of operations in 2003 after the Numico acquisition.

As a result of the Numico acquisition, the consolidated statements of operations for the Apollo predecessor period include the following:

interest and amortization expense resulting from the December 2003 senior credit facility and issuance of senior subordinated notes in

December 2003 and senior notes in January 2005; amortization of intangible assets related to the Numico acquisition; and management fees

that did not exist prior to the Numico acquisition. Further, as a result of purchase accounting, the fair values of our assets on the date of the

Numico acquisition became their new cost basis.

On February 8, 2007, our parent corporation entered into an Agreement and Plan of Merger with GNC Acquisition Inc. and its parent

company, GNC Acquisition Holdings, Inc., pursuant to which GNC Acquisition Inc. agreed to merge with and into GNC Parent Corporation, and

as a result GNC Parent Corporation would continue as the surviving corporation and a wholly owned subsidiary of GNC Acquisition Holdings

Inc. This Merger was accounted for under the purchase method of accounting. As a result, the financial data presented as of December 31,

2007, and for the period from March 16, 2007 to December 31, 2007 represents, the period of operations after the Merger.

As a result of the Merger, the consolidated statement of operations for the successor period includes the following: interest and

amortization expense resulting from the issuance of the Senior Floating Rate Toggle Notes and the 10.75% Senior Subordinated Notes; and

amortization of intangible assets related to the Merger. Further, as a result of purchase accounting, the fair values of our assets on the date of

the Merger became their new cost basis.

You should read the following financial information together with the information under Item 7, "Management's Discussion and Analysis of

Financial Condition and Results of Operations" and our consolidated financial statements and their related notes.

36