GNC 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

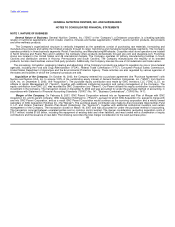

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. NATURE OF BUSINESS

General Nature of Business. General Nutrition Centers, Inc. ("GNC" or the "Company"), a Delaware corporation, is a leading specialty

retailer of nutritional supplements, which include: vitamins, minerals and herbal supplements ("VMHS"), sports nutrition products, diet products

and other wellness products.

The Company's organizational structure is vertically integrated as the operations consist of purchasing raw materials, formulating and

manufacturing products and selling the finished products through its retail, franchising and manufacturing/wholesale segments. The Company

operates primarily in three business segments: Retail; Franchising; and Manufacturing/Wholesale. Corporate retail store operations are located

in North America and Puerto Rico and in addition the Company offers products domestically through gnc.com and drugstore.com. Franchise

stores are located in the United States and 49 international markets. The Company operates its primary manufacturing facilities in South

Carolina and distribution centers in Arizona, Pennsylvania and South Carolina. The Company manufactures the majority of its branded

products, but also merchandises various third-party products. Additionally, the Company licenses the use of its trademarks and trade names.

The processing, formulation, packaging, labeling and advertising of the Company's products are subject to regulation by one or more federal

agencies, including the Food and Drug Administration ("FDA"), Federal Trade Commission ("FTC"), Consumer Product Safety Commission,

United States Department of Agriculture and the Environmental Protection Agency. These activities are also regulated by various agencies of

the states and localities in which the Company's products are sold.

Acquisition of the Company. On October 16, 2003, the Company entered into a purchase agreement (the "Purchase Agreement") with

Numico and Numico USA, Inc. to acquire 100% of the outstanding equity interest of General Nutrition Companies, Inc. ("GNCI") from Numico

USA, Inc. on December 5, 2003, (the "Acquisition"). The purchase equity contribution was made by GNC Investors, LLC ("GNC LLC"), an

affiliate of Apollo Management LP ("Apollo"), together with additional institutional investors and certain management of the Company. The

equity contribution from GNC LLC was recorded by GNC Corporation (our "Parent"). Our Parent utilized this equity contribution to purchase its

investment in the Company. The transaction closed on December 5, 2003 and was accounted for under the purchase method of accounting, in

accordance with Statement of Financial Accounting Standards ("SFAS") No. 141, "Business Combinations", ("SFAS No. 141").

Merger of the Company. On February 8, 2007, GNC Parent Corporation entered into an Agreement and Plan of Merger with GNC

Acquisition Inc. and its parent company, GNC Acquisition Holdings Inc. ("Parent"), pursuant to which GNC Acquisition Inc. agreed to merge with

and into GNC Parent Corporation, and as a result GNC Parent Corporation would continue as the surviving corporation and a wholly owned

subsidiary of GNC Acquisition Holdings Inc. (the "Merger"). The purchase equity contribution was made by Ares Corporate Opportunities Fund

II, L.P. and Ontario Teachers' Pension Plan Board (collectively, the "Sponsors"), together with additional institutional investors and certain

management of the Company. The transaction closed on March 16, 2007 and was accounted for under the purchase method of accounting.

The transaction occurred between unrelated parties and no common control existed. The merger consideration (excluding acquisition costs of

$13.7 million) totaled $1.65 billion, including the repayment of existing debt and other liabilities, and was funded with a combination of equity

contributions and the issuance of new debt. The following reconciles the total merger consideration to the cash purchase price:

69