GNC 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

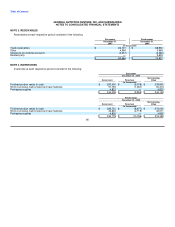

components of accounts receivable. To determine the allowance for doubtful accounts in accordance with SFAS No. 114, "Accounting by

Creditors for Impairment of a Loan (as amended)", factors that affect collectibility from the Company's franchisees or third-party customers

include their financial strength, payment history, reported sales and the overall retail economy. The Company establishes an allowance for

doubtful accounts for franchisees based on an assessment of the franchisees' operations which includes analysis of their operating cash flows,

sales levels, and status of amounts due to the Company, such as rent, interest and advertising. In addition, the Company considers the

franchisees' inventory and fixed assets, which the Company can use as collateral in the event of a default by the franchisee. An allowance for

international franchisees is calculated based on unpaid, non collateralized amounts associated with their receivable balance. An allowance for

receivable balances due from third parties is recognized, if considered necessary, based on facts and circumstances. These allowances are

deducted from the related receivables and reflected net in the accompanying financial statements.

Notes Receivable. The Company offers financing to qualified franchisees in connection with the initial purchase of a franchise store. The

notes offered by the Company to its franchisees are demand notes, payable monthly over a period ranging from five to seven years. Interest

accrues principally at an annual rate that ranges from 10.0% to 13.75%, based on the amount of initial deposit, and is payable monthly.

Allowances for these receivables are recognized in accordance with the Company's policy described in the Accounts Receivable and Allowance

for Doubtful Accounts policy.

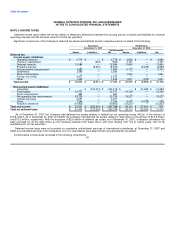

Property, Plant and Equipment. Property, plant and equipment expenditures are recorded at cost. As a result of the Merger, the remaining

estimated useful lives of already-existing property and equipment were reevaluated on a prospective basis using the fair values determined at

the date of the Merger. These remaining useful lives ranged from 1 year to 16 years across all asset classes with the exception of buildings,

whose useful lives ranged from 15 to 37 years. Depreciation and amortization are recognized using the straight-line method over the estimated

useful life of the property. Fixtures are depreciated over three to eight years, and equipment is generally depreciated over ten years. Computer

equipment and software costs are generally depreciated over three years. Amortization of improvements to retail leased premises is recognized

using the straight-line method over the estimated useful life of the improvements, or over the life of the related leases including renewals that

are reasonably assured, whichever period is shorter. Buildings are depreciated over 40 years and building improvements are depreciated over

the remaining useful life of the building. The Company records tax depreciation in conformity with the provisions of applicable tax law.

Expenditures that materially increase the value or clearly extend the useful life of property, plant and equipment are capitalized in

accordance with the policies outlined above. Repair and maintenance costs incurred in the normal operations of business are expensed as

incurred. Gains from the sale of property, plant and equipment are recognized in current operations.

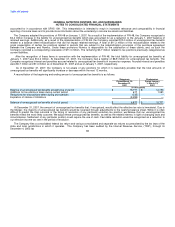

The Company recognized depreciation expense of property, plant and equipment of $6.5 million for the period January 1 to March 15, 2007,

$20.8 million for the period March 16 to December 31, 2007, $34.6 million and $37.0 million for the years ended December 31, 2006 and 2005.

Goodwill and Intangible Assets. Goodwill represents the excess of purchase price over the fair value of identifiable net assets of acquired

entities. Goodwill and intangible assets with indefinite useful lives are not amortized, but instead are tested for impairment at least annually. The

Company completes its annual impairment test in the fourth quarter. The Company records goodwill and franchise rights upon the acquisition of

franchisee stores when the consideration given to the franchisee exceeds the fair value of the identifiable assets acquired and liabilities

assumed of the store. This goodwill is accounted for in accordance with the above policy. See the footnote, "Goodwill and Intangible Assets".

Long-lived Assets. The Company periodically performs reviews of underperforming businesses and other long-lived assets, including

amortizable intangible assets, for impairment pursuant to the provisions of SFAS No. 144, "Accounting for the Impairment or Disposal of Long-

Lived Assets." These reviews may include an analysis of the current operations and capacity utilization, in conjunction with an

73