GNC 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

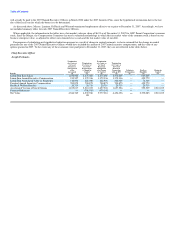

Messrs. Dowd's and Locke's employment agreements provided that the executive could have elected to receive the present value of the continuation of

base salary and their pro rated annual incentive compensation in a lump sum based upon a present value annual discount rate equal to 6%. We have assumed

for purposes of the table that such executives would not have made such election.

Finally, although there is no requirement to do so or guarantee that it would have been paid, we have assumed that, in the exercise of discretion by the

Compensation Committee, Messrs. Dowd, Weiss and Locke would have been paid their prorated annual performance bonus for the year in which their

employment was terminated based on a hypothetical termination date of the end of that year, other than in this case of such executive's voluntary termination

without good reason or a termination by the Company for cause.

Upon a termination of employment on December 31, 2007, the shares of our Parent's common stock owned by Messrs. Dowd, Weiss and Locke would

have been subject to repurchase by us or our designee for a period of 180 days (270 days upon termination because of death or disability) following the

termination based on fair value as determined by the Company Board.

Director Compensation

Pursuant to our director compensation policy, effective as August 15, 2007, we compensate our directors as follows: (i) our non-employee chairman

receives an annual retainer of $100,000 and (ii) our non-employee directors receive an annual retainer of $40,000. Effective February 2008, the Parent

Compensation Committee approved an increase in the annual retainer of the non-employee chairman to $200,000. Directors are not entitled to any additional

cash compensation such as fees for attending meetings. However, each non-employee director is entitled to receive a grant of non-qualified stock options to

purchase a minimum of 36,176 shares of Parent's common stock. Any director or chairman who is employed by Ares Corporate Opportunities Fund II, L.P.,

Ontario Teachers and other purchasers in connection with the Merger is not entitled to any retainers or stock option grants.

The director compensation policy in effect prior to the Merger provided for our executive chairman of the Company Board and each non-employee director

to receive an annual retainer of $40,000 and a stipend of $2,000 for each board meeting attended in person or $500 for each meeting attended telephonically.

Additionally, under that policy non-employee directors serving on board committees would receive a stipend of $1,000 for each meeting attended in person or

$500 for each meeting attended telephonically. In addition, each non-employee director, upon election or appointment to the Company Board would receive a

grant of non-qualified stock options to purchase a minimum of 42,675 shares of GNC Parent Corporation's common stock, with the number to be determined

by the Parent Board in its discretion. When granted, these director options were fully vested and immediately exercisable, had an exercise price equal to the

fair market value per share of the GNC Parent Corporation common stock on the date of grant, and expired in ten years, even upon the director's termination

of service with GNC Parent Corporation or us.

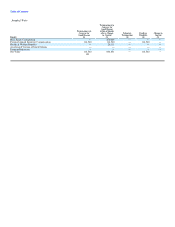

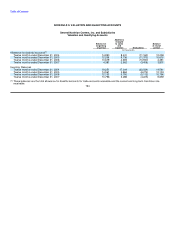

The table below sets forth information with respect to compensation for our directors for 2007. Other than Mr. Fortunato, who received no separate

director compensation, all of the directors serving on Company Board on March 16, 2007, resigned from the Company Board effective as of that date, the

closing date of the Merger. Mr. Larrimer was appointed as a member of the Company Board effective March 7, 2007 and was removed from such position by

our Parent effective March 16, 2007. Mr. Larrimer did not receive any separate director compensation. The compensation paid to Mr. DiNicola as a director is

reflected in the Summary Compensation Table above. Accordingly, Messrs. Fortunato, Larrimer, or DiNicola are therefore not listed in the table below.

Norman Axelrod, David B. Kaplan, Jeffery B. Schwartz, Lee Sienna, Josef Prosperi, Michele J. Buchignani and Robert M. Lynch were each appointed as

members of the Company Board effective as of March 16, 2007. Mr. Lynch resigned effective April 21, 2007 and did not receive any compensation for

serving as a director. As stated above, any employee employed by Ares or Ontario Teachers are not entitled to any

155