GNC 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

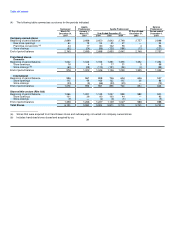

management, exclude certain items that are managed at the consolidated level, such as warehousing and transportation costs, impairments,

and other corporate costs. The following discussion compares the revenues and the operating income or loss by segment, as well as those

items excluded from the segment totals.

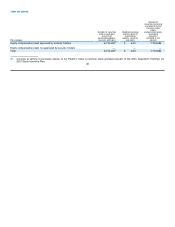

Same store sales growth reflects the percentage change in same store sales in the period presented compared to the prior year period.

Same store sales are calculated on a daily basis for each store and exclude the net sales of a store for any period if the store was not open

during the same period of the prior year. Beginning in the first quarter of 2006, we also included our internet sales, as generated through

www.gnc.com and drugstore.com, in our domestic company-owned same store sales calculation. When a store's square footage has been

changed as a result of reconfiguration or relocation in the same mall or shopping center, the store continues to be treated as a same store. If,

during the period presented, a store was closed, relocated to a different mall or shopping center, or converted to a franchised store or a

company-owned store, sales from that store up to and including the closing day or the day immediately preceding the relocation or conversion

are included as same store sales as long as the store was open during the same period of the prior year. We exclude from the calculation sales

during the period presented from the date of relocation to a different mall or shopping center and from the date of a conversion. In the second

quarter of 2006, we modified the calculation method for domestic franchised same store sales consistent with this description, which has been

the method historically used for domestic company-owned same store sales.

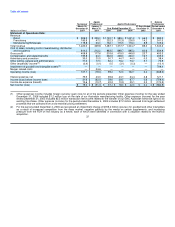

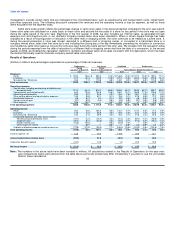

Results of Operations

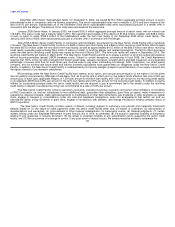

(Dollars in millions and percentages expressed as a percentage of total net revenues)

Predecessor Successor Combined Predecessor

Period Period

January 1 to March 15, March 16 to December 31, Twelve Months Ended December 31,

2007 2007 2007 2006 2005

Revenues:

Retail $ 259.3 78.6% $ 909.3 74.3% $1,168.6 75.3% $1,122.7 75.5% $ 989.4 75.1%

Franchise 47.2 14.3% 193.9 15.9% 241.1 15.5% 232.3 15.6% 212.8 16.1%

Manufacturing / Wholesale 23.3 7.1% 119.8 9.8% 143.1 9.2% 132.1 8.9% 115.5 8.8%

Total net revenues 329.8 100.0% 1,223.0 100.0% 1,552.8 100.0% 1,487.1 100.0% 1,317.7 100.0%

Operating expenses:

Cost of sales, including warehousing, distribution and

occupancy costs 212.2 64.4% 814.2 66.5% 1,026.4 66.1% 983.5 66.1% 898.7 68.2%

Compensation and related benefits 64.3 19.5% 195.8 16.0% 260.1 16.7% 260.8 17.5% 228.6 17.3%

Advertising and promotion 20.5 6.2% 35.0 2.9% 55.5 3.6% 50.7 3.4% 44.7 3.4%

Other selling, general and administrative expenses 16.5 5.0% 62.1 5.1% 78.6 5.1% 87.8 6.0% 72.2 5.5%

Amortization expense 0.8 0.2% 9.2 0.7% 10.0 0.6% 4.6 0.3% 4.0 0.3%

Foreign currency gain (0.1) 0.0% (0.4) 0.0% (0.5) 0.0% (0.7) 0.0% (0.6) 0.0%

Other expense 34.6 10.5% — 0.0% 34.6 2.2% 1.2 0.0% (2.5) -0.2%

Total operating expenses 348.8 105.8% 1,115.9 91.2% 1,464.7 94.3% 1,387.9 93.3% 1,245.1 94.5%

Operating income:

Retail 28.2 8.6% 106.5 8.8% 134.7 8.7% 127.4 8.6% 77.2 5.9%

Franchise 14.5 4.4% 55.0 4.5% 69.5 4.5% 64.1 4.3% 52.0 3.9%

Manufacturing / Wholesale 10.3 3.1% 38.9 3.2% 49.2 3.1% 51.0 3.4% 46.0 3.5%

Unallocated corporate and other (costs) income:

Warehousing and distribution costs (10.7) -3.2% (40.7) -3.3% (51.4) -3.3% (50.7) -3.4% (50.0) -3.8%

Corporate costs (26.7) -8.2% (52.6) -4.4% (79.3) -5.1% (91.4) -6.2% (55.1) -4.2%

Merger-related costs (34.6) -10.5% — 0.0% (34.6) -2.2% — 0.0% — 0.0%

Other (expense) income — 0.0% — 0.0% — 0.0% (1.2) 0.0% 2.5 0.2%

Subtotal unallocated corporate and other costs net (72.0) -21.9% (93.3) -7.7% (165.3) -10.6% (143.3) -9.6% (102.6) -7.8%

Total operating income (19.0) -5.8% 107.1 8.8% 88.1 5.7% 99.2 6.7% 72.6 5.5%

Interest expense, net 43.0 75.5 118.5 39.6 43.1

(Loss) Income before income taxes (62.0) 31.6 (30.4) 59.6 29.5

Income tax (benefit) expense (10.7) 12.6 1.9 22.2 10.9

Net (loss) income $ (51.3) $ 19.0 $ (32.3) $ 37.4 $ 18.6

Note: The numbers in the above table have been rounded to millions. All calculations related to the Results of Operations for the year-over-

year comparisons below were derived from the table above and could occasionally differ immaterially if you were to use the unrounded

data for these calculations. 43