GNC 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

For the 2008 Incentive Plan, the payment amount will be pro rated for budgeted EBITDA achieved between the Target and Maximum levels.

We do not disclose our internal budget for results of operations, including budgeted EBITDA (as determined by the Company Board). This

amount constitutes confidential financial information, and we believe that disclosure of this amount, whether with respect to historical periods or

future periods, would cause us competitive harm by disclosing to competitors a key element of our internal projections.

Based on our financial performance in 2007, we achieved a goal that exceeded target, but was less than the maximum threshold as

described in the table above. As a result, in March 2008 each of our Named Executive Officers will be paid an amount above the target, but

less than the maximum possible annual incentive compensation under the 2007 Incentive Plan. Management believes that achieving 100%, or

more, of the goal of meeting or exceeding 100% of budgeted EBITDA set in the 2008 Incentive Plan, while possible to achieve for our Named

Executive Officers, will present a significant challenge.

Generally, an annual performance bonus is payable only if the Named Executive Officer is employed by us on the date payment is made.

Stock Options. We believe that equity-based awards are an important factor in aligning the long-term financial interest of our Named

Executive Officers and stockholders. The Compensation Committee continually evaluates the use of equity-based awards and intends to

continue to use such awards in the future as part of designing and administering the Company's compensation program. see "— Stock Awards"

above for more information regarding our stock option grants.

We follow a practice of granting equity incentives in the form of stock options in order to grant awards that contain both substantial incentive

and retention characteristics. These awards are designed to provide emphasis on providing significant incentives for continuing growth in

stockholder value. Stock options are generally granted on an annual basis, except for new employees on the commencement of their

employment and to existing employees following a significant change in job responsibilities or to recognize special performance.

The Parent Compensation Committee determines stock option grant awards in accordance with the Named Executive Officer's performance

and level of position. Before the Merger, stock options generally were subject to vesting in annual installments on the first four anniversaries of

the date of grant and had a term of seven years.

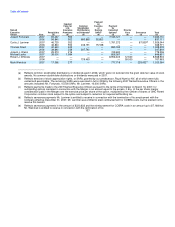

The stock options granted in connection with the closing date of the Merger under the 2007 Stock Plan to our Named Executive Officers and

non-employee directors, other than our Chief Executive Officer, were equally divided between non-qualified options granted at an exercise price

of $5.00 per share, which is 100% of the purchase price per share in connection with all of the equity contributions to fund a portion of the

Merger, and non-qualified options granted at an exercise price of $7.50, which is 150% of that purchase price. They are subject to annual

vesting over a five-year period (subject to continued employment through the vesting dates), may be accelerated in certain circumstances, and

have a term of ten years.

Our Chief Executive Officer was granted both incentive stock options and non-qualified stock options, as follows: (1) an incentive stock

option to purchase 80,000 shares of Class A common stock at an exercise price per share of $5.00; (2) a non-qualified stock option to purchase

1,182,877 shares of Class A common stock at an exercise price per share of $5.00; and a (3) a non-qualified stock option to purchase

1,262,877 shares of Class A common stock at an exercise price per share of $7.50. Each of these options vest in annual installments over a

four-year period (subject to his continued employment), may be accelerated in certain circumstances, and have a term of ten years.

Benefits and Perquisites. We provide a fringe benefit package for our Named Executive Officers. Generally, our Named Executive Officers

are entitled to participate in, and to receive benefits under, any 130