GNC 2008 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

Table of Contents

Mr. Fortunato entered into an employment agreement in connection with the Merger. See "—Employment Agreements with Our 2007 Named Executive

Officers — Chief Executive Officer" for a description of the severance and change in control benefits provided under Mr. Fortunato's employment agreement.

As stated above, Mr. Fortunato's employment agreements provides that if any payment would have been subject to or result in the imposition of the excise

tax imposed by Section 4999 of the Internal Revenue Code, then the amount of such payments would have been reduced to the highest amount that may be

paid by us without subjecting such payment to the excise tax. Mr. Fortunato's employment agreement provides that the reduction will not apply if he would,

on a net after-tax basis, receive less compensation than if the payment were not so reduced. Based on a hypothetical change in control on December 31, 2007,

Mr. Fortunato would have been subject to a reduction payment if his employment had also been terminated at the time of a December 31, 2007 change in

control or on December 31, 2007 in anticipation of a change in control, but not upon a change in control without an employment termination. The calculation

of the payment reduction amounts do not include a valuation of the non-competition covenant in Mr. Fortunato's employment agreements. A portion of the

severance payments payable to Mr. Fortunato may be attributable to reasonable compensation for the non-competition covenant and could eliminate or reduce

the reduction amount.

Finally, although there is no requirement to do so or guarantee that it would have been paid, we have assumed that, in the exercise of discretion by the

Compensation Committee, Mr. Fortunato would have been paid his prorated annual incentive compensation for the year in which his employment was

terminated based on a hypothetical termination date of the end of that year, other than in this case of his voluntary termination without good reason or a

termination by the Company for cause.

Upon a termination of employment on December 31, 2007, the shares of our Parent's common stock owned by Mr. Fortunato would have been subject to

repurchase by us or our designee for a period of 180 days (270 days upon termination because of death or disability) following the termination based on fair

value as determined by the Company Board.

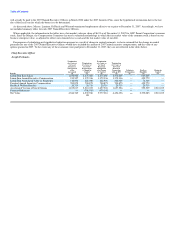

Other 2007 Named Executive Officers

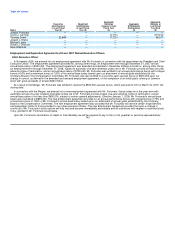

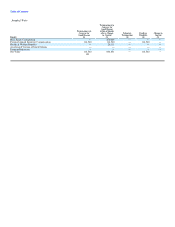

Thomas Dowd

Termination w/o

Cause or for

Good Reason

Termination w/o within 6 Months

Cause or for after a Change Voluntary Death or Change in

Good Reason in Control Termination Disability Control

Benefit ($) ($) ($) ($) ($)

Base Salary Continuation — 640,000 — — —

Prorated Annual Incentive Compensation 168,702 168,702 — 168,702 —

Health & Welfare Benefits — 20,311 — — —

Accelerated Vesting of Stock Options — — — — —

Payment Reduction — — — — —

Net Value 168,702 829,013 — 168,702 —

152