GNC 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

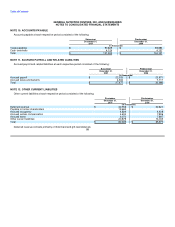

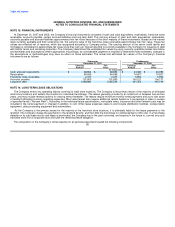

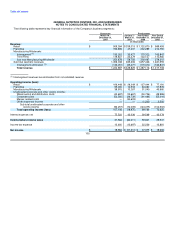

Successor Predecessor

March 16- January 1-

December 31, March 15, Year Ended December 31,

2007 2007 2006 2005

(in thousands)

Retail stores:

Rent on long-term operating leases, net of sublease income $ 83,867 $ 20,887 $ 99,194 $ 96,952

Landlord related taxes 12,138 2,987 14,920 13,678

Common operating expenses 24,659 6,364 28,143 26,619

Percent rent 9,880 2,863 12,035 9,571

130,544 33,101 154,292 146,820

Truck fleet 3,441 904 4,295 4,413

Other 6,847 4,031 10,505 10,131

$ 140,832 $ 38,036 $ 169,092 $ 161,364

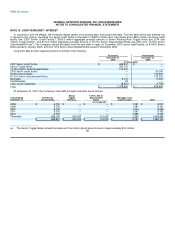

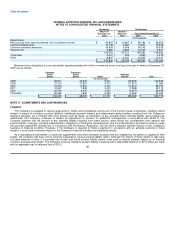

Minimum future obligations for non-cancelable operating leases with initial or remaining terms of at least one year in effect at December 31,

2007 are as follows:

Company Franchise

Retail Retail Sublease

Stores Stores Other Income Total

(in thousands)

2008 94,977 25,876 5,672 (25,876) 100,649

2009 72,307 17,657 4,773 (17,657) 77,080

2010 54,376 11,814 4,415 (11,814) 58,791

2011 41,637 7,809 3,475 (7,809) 45,112

2012 26,146 3,227 2,353 (3,227) 28,499

Thereafter 50,582 1,653 2,463 (1,653) 53,045

$ 340,025 $ 68,036 $ 23,151 $ (68,036) $ 363,176

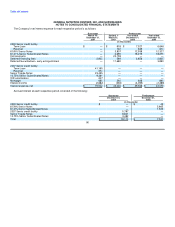

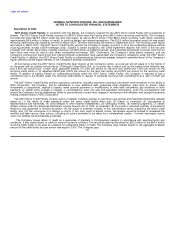

NOTE 17. COMMITMENTS AND CONTINGENCIES

Litigation

The Company is engaged in various legal actions, claims and proceedings arising out of the normal course of business, including claims

related to breach of contracts, product liabilities, intellectual property matters and employment-related matters resulting from the Company's

business activities. As is inherent with most actions such as these, an estimation of any possible and/or ultimate liability cannot always be

determined. The Company continues to assess its requirement to account for additional contingencies in accordance with SFAS 5. The

Company believes that the amount of any potential liability resulting from these actions, when taking into consideration their general and

product liability coverage, including indemnification obligations of third-party manufacturers, and the indemnification provided by Numico under

the purchase agreement entered into in connection with the Numico Acquisition, will not have a material adverse impact on the Company's

business or financial condition. However, if the Company is required to make a payment in connection with an adverse outcome in these

matters, it could have a material impact on the Company's financial condition and operating results.

As a manufacturer and retailer of nutritional supplements and other consumer products that are ingested by consumers or applied to their

bodies, the Company has been and is currently subjected to various product liability claims. Although the effects of these claims to date have

not been material to them, it is possible that current and future product liability claims could have a material adverse impact on its financial

condition and operating results. The Company currently maintains product liability insurance with a deductible/retention of $2.0 million per claim

with an aggregate cap on retained loss of $10.0 96