GNC 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

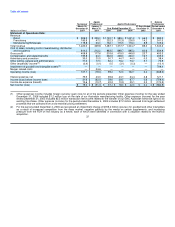

Other Expense / Income

Other expense for the year ended December 31, 2007 included costs related to the Merger, which were $34.6 million. These costs were

comprised of selling-related expenses of $26.4 million, a contract termination fee paid to our previous owner of $7.5 million, and other costs of

$0.7 million.

Other expense for the year ended December 31, 2006 was $1.2 million, as a result of the loss on the sale of our Australian subsidiary,

which was completed in the fourth quarter of 2006.

Operating Income

As a result of the foregoing, consolidated operating income decreased $11.1 million, or 11.1%, to $88.1 million for the year ended

December 31, 2007 compared to $99.2 million for the same period in 2006. Operating income, as a percentage of net revenue, was 5.7% for

the year ended December 31, 2007 compared to 6.7% for the year ended December 31, 2006.

Included in the 2007 operating income was (1) $15.4 million of amortization as a result of purchase accounting from the Merger; and (2)

$34.6 million of fees and expenses associated with the Merger and $15.3 million of compensation related costs associated with the Merger,

which included $9.6 million of option related payments and associated payroll taxes, $3.8 million of non-cash compensation related to the

cancellation of stock options at the merger date and $1.9 million of incentives paid at the completion of the Merger. The 2006 operating income

included $22.6 million in discretionary payments made to stock option holders and accruals for future payments in conjunction with a distribution

made to shareholders in March and December 2006, and $1.2 million of loss related to the sale of our Australian facility.

Retail. Operating income increased $7.3 million, or 5.7%, to $134.7 million for the year ended December 31, 2007 compared to

$127.4 million for the same period in 2006. Revenue and margin increases were offset by $9.6 million of amortization of inventory step up and

lease adjustments as a result of the Merger.

Franchise. Operating income increased $5.4 million, or 8.5%, to $69.5 million for the year ended December 31, 2007 compared to

$64.1 million for the same period in 2006. This increase is primarily attributable to an increase in margins related to wholesale sales to our

international and domestic franchisees, offset by amortization expense of $0.1 million for inventory step up as a result of the Merger.

Manufacturing/Wholesale. Operating income decreased $1.8 million, or 3.6%, to $49.2 million for the year ended December 31, 2007

compared to $51.0 million for the same period in 2006. This decrease was primarily the result of higher third-party contract sales volume and

margins offset by $5.7 million expense from amortization of inventory step up as a result of the Merger.

Warehousing and Distribution Costs. Unallocated warehousing and distribution costs increased $0.7 million, or 1.3%, to $51.4 million for

the year ended December 31, 2007 compared to $50.7 million for the same period in 2006. This increase was primarily a result of increased

fuel costs, as well as the cost of common carriers.

Corporate Costs. Corporate overhead cost decreased $12.1 million, or 13.2%, to $79.3 million for the year ended December 31, 2007

compared to $91.4 million for the same period in 2006. This decrease was primarily the result of Merger related compensation costs of

$15.3 million and an increase in self-insurance costs offset by reductions in (1) incentive compensation expense; (2) professional fees; and

(3) legal settlement expenses. Additionally, the 2006 costs included $22.6 million in discretionary payments made to stock option holders and

accruals for future payments in conjunction with distributions made to shareholders in March and December 2006.

Merger Related Costs. Merger related costs for the year ended December 31, 2007 included costs by our parent, and recognized by us,

in relation to the Merger, of $34.6 million. These costs were comprised46