GNC 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

employee contributions of 1% to 80% of individual compensation into deferred savings, subject to IRS limitations. The plan provides for

Company contributions upon the employee meeting the eligibility requirements. The contribution match was temporarily suspended as of

June 30, 2003, and was reinstated in January 2004. Effective April 1, 2005, the Company match consists of both a fixed and a discretionary

match. The fixed match is 50% on the first 3% of the salary that an employee defers and the discretionary match could be up to an additional

100% match on the 3% deferral. A discretionary match can be approved at any time by the Company.

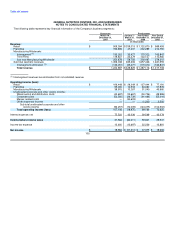

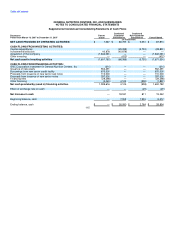

An employee becomes vested in the Company match portion as follows:

Percent

Years of Service Vested

0-1 0%

1-2 33%

2-3 66%

3+ 100%

The Company made cash contributions of $0.3 million for the period January 1 to March 15, 2007, $0.9 million for the period March 16 to

December 31, 2007, $1.2 million, and $1.4 million for the years ended December 31, 2006 and 2005, respectively. In addition, the Company

made a discretionary match for the 2006 plan year of $1.2 million made in February 2007 and will make a discretionary match for the 2007 plan

year of $0.6 million in March 2008.

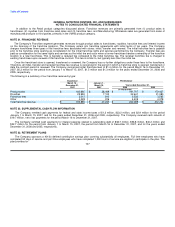

The Company has a Non-qualified Executive Retirement Arrangement Plan that covers key employees. Under the provisions of this plan,

certain eligible key employees are granted cash compensation, which in the aggregate was not significant for any year presented.

The Company has a Non-qualified Deferred Compensation Plan that provides benefits payable to certain qualified key employees upon their

retirement or their designated beneficiaries upon death. This plan allows participants the opportunity to defer pretax amounts ranging from 2%

to 100% of their base compensation plus bonuses. The plan is funded entirely by elective contributions made by the participants. The Company

has elected to finance any potential plan benefit obligations using corporate owned life insurance policies. As of December 31, 2007, plan

assets approximated plan liabilities.

NOTE 24. RELATED PARTY TRANSACTIONS

Successor:

Management Services Agreement. Upon consummation of the Merger, the Company entered into a services agreement with its Parent,

GNC Acquisition Holdings Inc ("Holdings"). Under the agreement, Holdings agreed to provide the Company and its subsidiaries with certain

services in exchange for an annual fee of $1.5 million, as well as customary fees for services rendered in connection with certain major financial

transactions, plus reimbursement of expenses and a tax gross-up relating to a non-tax deductible portion of the fee. The company agreed to

provide customary indemnifications to Holdings and its affiliates and those providing services on its behalf. In addition, upon consummation of

the Merger, the Company incurred an aggregate fee of $10.0 million, plus reimbursement of expenses, payable to Holdings for services

rendered in connection with the Merger. As of December 31, 2007, $1.2 million had been paid pursuant to this agreement.

Credit Facility. Upon consummation of the Merger, the Company entered into a $735.0 million credit agreement, of which various Ares fund

portfolios, which are related to the one of our sponsors, are investors. As of December 31, 2007, certain affiliates of Ares Management LLC

held approximately $64.5 million of term loans under the Company's 2007 Senior Credit Facility.

108