GNC 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

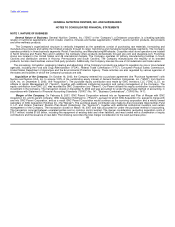

subsequent reporting date. Eligible items include, but are not limited to, accounts and loans receivable, available-for-sale and held-to-maturity

securities, equity method investments, accounts payable, guarantees, issued debt and firm commitments. SFAS No. 159 is effective for fiscal

years beginning after November 15, 2007. We continue to evaluate the adoption of SFAS 159 and its impact on our consolidated financial

statements or results of operations.

In September 2006, the FASB issued FAS No. 157, "Fair Value Measurements." This Statement defines fair value, establishes a

framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. The

Statement applies under other accounting pronouncements that require or permit fair value measurements and, accordingly, does not require

any new fair value measurements. This Statement was initially effective as of January 1, 2008, but in February 2008, the FASB delayed the

effectiveness date for applying this standard to nonfinancial assets and nonfinancial liabilities that are not currently recognized or disclosed at

fair value in the financial statements. The effectiveness date of January 1, 2008 applies to all other assets and liabilities within the scope of this

standard. We do not expect any material financial statement implications relating to the adoption of this Statement.

In September 2006, the Securities and Exchange Commission ("SEC") issued Staff Accounting Bulletin No. 108, "Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements" ("SAB 108"). This bulletin expresses the

SEC's views regarding the process of quantifying financial statement misstatements. The interpretations in this bulletin are being issued to

address diversity in practice in quantifying financial statement misstatements and the potential under current practice for the build up of

improper amounts on the balance sheet. This statement is effective for annual financial statements with years ending December 31, 2006. We

have adopted SAB 108 for the year ended December 31, 2006. We have evaluated the effects of applying SAB 108 and have determined that

its adoption does not have a material impact on our consolidated financial statements or results of operations.

In March 2006, the FASB's Emerging Issues Task Force ("EITF") issued EITF Abstract Issue No. 06-03, "How Taxes Collected from

Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That is, Gross versus Net Presentation)"

("EITF 06-03"), that clarifies how a company discloses its recording of taxes collected that are imposed on revenue producing activities. EITF

06-03 is effective for the first interim reporting period beginning after December 15, 2006. We have evaluated the effects of applying EITF 06-03

and have determined that its adoption does not have a material impact on our consolidated financial statements or results of operations.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations ("SFAS 141R"). SFAS 141R establishes

principles and requirements for how an acquirer in a business combination recognizes and measures in its financial statements the identifiable

assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at the acquisition date fair value. SFAS 141R

significantly changes the accounting for business combinations in a number of areas including the treatment of contingent consideration,

preacquisition contingencies, transaction costs, in-process research and development and restructuring costs. In addition, under SFAS 141R,

changes in an acquired entity's deferred tax assets and uncertain tax positions after the measurement period will impact income tax expense.

SFAS 141R provides guidance regarding what information to disclose to enable users of the financial statements to evaluate the nature and

financial effects of the business combination. SFAS 141R also amends SFAS 109, Accounting for Income Taxes and acquired tax

contingencies after January 1, 2009, even for business combinations completed before this date. SFAS 141R is effective for fiscal years

beginning after December 15, 2008 with early application prohibited. We will adopt SFAS 141R beginning in the first quarter of fiscal 2009 and

will change its accounting treatment for business combinations on a prospective basis. We are currently evalutating the impact of adopting

SFAS 141R on our consolidated financial statements.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements, an amendment of ARB

No. 51 ("SFAS 160"). SFAS 160 changes the accounting and reporting for minority interests, which will be recharacterized as noncontrolling

interests and classified as a 60