GNC 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

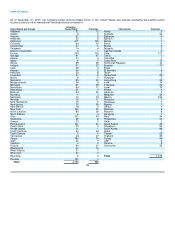

Table of Contents

ITEM 1A. RISK FACTORS.

The following risk factors, among others, could cause our financial performance to differ significantly from the goals, plans, objectives,

intentions and expectations expressed in this report. If any of the following risks and uncertainties or other risks and uncertainties not currently

known to us or not currently considered to be material actually occur, our business, financial condition, or operating results could be harmed

substantially.

Risks Relating to Our Business and Industry

We operate in a highly competitive industry. Our failure to compete effectively could adversely affect our market share, revenues, and

growth prospects.

The U.S. nutritional supplements retail industry is large and highly fragmented. Participants include specialty retailers, supermarkets,

drugstores, mass merchants, multi-level marketing organizations, on-line merchants, mail-order companies, and a variety of other smaller

participants. We believe that the market is also highly sensitive to the introduction of new products, including various prescription drugs, which

may rapidly capture a significant share of the market. In the United States, we also compete for sales with heavily advertised national brands

manufactured by large pharmaceutical and food companies, as well as other retailers. In addition, as some products become more mainstream,

we experience increased competition for those products as more participants enter the market. For example, when the trend in favor of low-

carbohydrate products developed, we experienced increased competition for our diet products from supermarkets, drug stores, mass

merchants, and other food companies, which adversely affected sales of our diet products. Our international competitors include large

international pharmacy chains, major international supermarket chains, and other large U.S.-based companies with international operations.

Our wholesale and manufacturing operations compete with other wholesalers and manufacturers of third-party nutritional supplements. We may

not be able to compete effectively and our attempt to do so may require us to reduce our prices, which may result in lower margins. Failure to

effectively compete could adversely affect our market share, revenues, and growth prospects.

Unfavorable publicity or consumer perception of our products and any similar products distributed by other companies could cause

fluctuations in our operating results and could have a material adverse effect on our reputation, the demand for our products, and

our ability to generate revenues.

We are highly dependent upon consumer perception of the safety and quality of our products, as well as similar products distributed by

other companies. Consumer perception of products can be significantly influenced by scientific research or findings, national media attention,

and other publicity about product use. A product may be received favorably, resulting in high sales associated with that product that may not be

sustainable as consumer preferences change. Future scientific research or publicity could be unfavorable to our industry or any of our particular

products and may not be consistent with earlier favorable research or publicity. A future research report or publicity that is perceived by our

consumers as less favorable or that questions earlier research or publicity could have a material adverse effect on our ability to generate

revenues. For example, sales of some of our VMHS products, such as St. John's Wort, Sam-e, and Melatonin, and more recently sales of

Vitamin E, were initially strong, but we believe decreased substantially as a result of negative publicity. As a result of the above factors, our

operations may fluctuate significantly from quarter to quarter, which may impair our ability to make payments when due on our debt. Period-to-

period comparisons of our results should not be relied upon as a measure of our future performance. Adverse publicity in the form of published

scientific research or otherwise, whether or not accurate, that associates consumption of our products or any other similar products with illness

or other adverse effects, that questions the benefits of our or similar products, or that claims that such products are ineffective could have a

material adverse effect on our reputation, the demand for our products, and our ability to generate revenues.

18