EasyJet 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 easyJet plc Annual report and accounts 2014

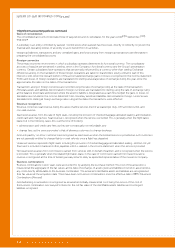

Independent auditors’ report to the members of easyJet plc continued

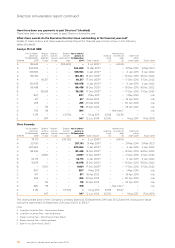

Area of focus How our audit addressed the area of focus

Aircraft maintenance provisions

The Group operates aircraft which are owned or held under finance

or operating lease arrangements and incurs liabilities for maintenance

costs in respect of aircraft leased under operating leases during the

term of the lease. These arise from legal and contractual obligations

relating to the condition of the aircraft when it is returned to the lessor.

Maintenance provisions of £226 million for aircraft maintenance

costs in respect of aircraft leased under operating leases are recorded

in the accounts at 30 September 2014 (refer to notes 1 and 17 to

the accounts).

At each balance sheet date, the calculation of the maintenance

provision includes a number of variable factors and assumptions

including: likely utilisation of the aircraft; the expected cost of the heavy

maintenance check at the time it is expected to occur; the condition

of the aircraft; and the lifespan of life-limited parts.

We focused on this area because of an inherent level of management

judgement required in calculating the amount of provision needed as

a result of the complex and subjective elements around these variable

factors and assumptions.

We evaluated the maintenance provision

model and tested the calculations therein.

This included assessing the process by which

the variable factors within the provision were

estimated, evaluating the reasonableness of

the assumptions, testing the input data and

reperforming calculations.

In particular, we challenged the key

assumptions using the Group’s internal data,

such as business plans and maintenance

contract terms. We also performed sensitivity

analysis around the key drivers of the model.

Having ascertained the magnitude of

movements in those key assumptions,

that either individually or collectively would

be required for the provision to be misstated,

we considered the likelihood of such

movements arising and any impact on

the overall level of aircraft maintenance

provisions recorded in the accounts.

Treasury operations

The Group holds significant net funds, comprising cash and money

market deposits and borrowings through bank loans and finance lease

obligations. Given the nature of the business, the Group also makes use

of derivative financial instruments. Forward contracts are used to hedge

transaction currency risk (comprising fuel, leasing and maintenance

US dollar payments), jet fuel price risk, and euro and Swiss franc

revenue receipts.

At 30 September 2014, cash and money market deposits amount to

£985 million, borrowings are £563 million, derivative financial assets

amount to £89 million and derivative financial liabilities are £110 million.

Further details are set out in notes 1, 13, 15, 22 and 23 to the accounts.

We focused on these balances because of their materiality to

the financial position of the Group, the volume of transactions

passing through the respective accounts and the number of

counterparties involved.

We evaluated and assessed the processes,

procedures and controls in respect of the

Group’s treasury and other management

functions which directly impact the relevant

account balances and transactions. We tested

management’s year end account reconciliation

process. The results of this work allowed us

to focus on substantiating the year-end

positions recorded in the accounts.

We independently obtained third-party

confirmations from each counterparty as

at the year end position. We assessed the

appropriateness of hedge accounting for the

derivative financial instruments and tested,

using independent data-feeds, the fair values

being ascribed to those instruments at the

year end.

We also assessed the appropriateness of

the disclosures in the accounts in respect

of both non-derivative and derivative

financial instruments.

The scope of our audit and our areas of focus

We conducted our audit in accordance with International Standards on Auditing (UK and Ireland) (“ISAs (UK & Ireland)”).

We designed our audit by determining materiality and assessing the risks of material misstatement in the accounts. In

particular, we looked at where the Directors made subjective judgements, for example in respect of significant accounting

estimates that involved making assumptions and considering future events that are inherently uncertain.

As in all of our audits, we also addressed the risk of management override of internal controls, including evaluating

whether there is evidence of bias by the Directors that may represent a risk of material misstatement due to fraud.

The risks of material misstatement that had the greatest effect on our audit, including the allocation of our resources and

effort, are identified as “areas of focus” in the table below together with an explanation of how we tailored our audit to

address these specific areas. This is not a complete list of all risks identified by our audit.