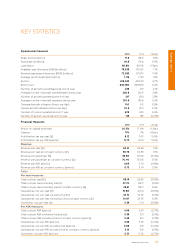

EasyJet 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 easyJet plc Annual report and accounts 2014

Financial review continued

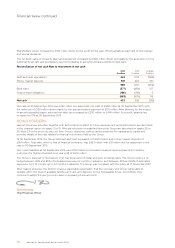

Shareholders’ equity increased by £155 million driven by the profit for the year, offset partially by payment of the ordinary

and special dividends.

The net book value of property, plant and equipment increased by £262 million driven principally by the acquisition of nine

A320 family aircraft, and pre-delivery payments relating to aircraft purchases and life-limited parts.

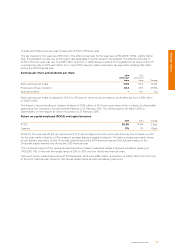

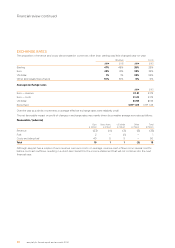

Reconciliation of net cash flow to movement in net cash

2014

£ million

2013

£ million

Change

£ million

Cash and cash equivalents 424 1,013 (589)

Money market deposits 561 224 337

985 1,237 (252)

Bank loans (377) (484) 107

Finance lease obligations (186) (195) 9

(563) (679) 116

Net cash 422 558 (136)

Net cash at 30 September 2014 was £422 million compared with net cash of £558 million at 30 September 2013, with

the reduction of £136 million driven mainly by the special dividend payment of £175 million. After allowing for the impact

of aircraft operating leases, adjusted net debt has increased by £290 million to £446 million. As a result, gearing has

increased to 17% at 30 September 2014.

GOING CONCERN

easyJet’s business activities, together with factors likely to affect its future development and performance, are described

in this strategic report on pages 2 to 51. Principal risks and uncertainties facing the Group are described on pages 28 to

35. Note 23 to the accounts sets out then Group’s objectives, policies and procedures for managing its capital and

provides details of the risks related to financial instruments held by the Group.

At 30 September 2014, the Group held cash and cash equivalents of £424 million and money market deposits of

£561 million. Total debt, which is free of financial covenants, was £563 million, with £91 million due for repayment in the

year to 30 September 2015.

Net current liabilities at 30 September 2014 were £159 million but included unearned revenue (payments made by

customers for flights scheduled post year end) of £572 million.

The Group is exposed to fluctuations in jet fuel prices and US dollar and euro exchange rates. The Group’s policy is to

hedge between 65% and 85% of estimated exposures 12 months in advance, and between 45% and 65% of estimated

exposures from 13 months up to 24 months in advance. The Group was compliant with this policy at 17 November 2014.

After making enquiries, the Directors have a reasonable expectation that the Company and Group will be able to

operate within the level of available facilities and cash and deposits for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing these accounts.

Chris Kennedy

Chief Financial Officer