EasyJet 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts & other information

www.easyJet.com 113

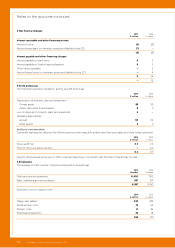

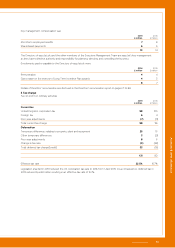

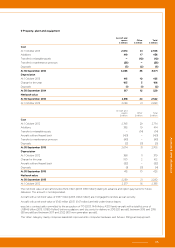

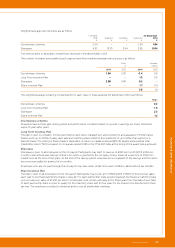

6 Earnings per share

Basic earnings per share has been calculated by dividing the profit for the year by the weighted average number of shares in

issue during the year after adjusting for shares held in employee benefit trusts.

To calculate diluted earnings per share, the weighted average number of ordinary shares in issue is adjusted to assume

conversion of all dilutive potential shares. Share options granted to employees where the exercise price is less than the average

market price of the Company’s ordinary shares during the year are considered to be dilutive potential shares. Where share

options are exercisable based on performance criteria and those performance criteria have been met during the year, these

options are included in the calculation of dilutive potential shares.

Earnings per share is based on:

2014

£ million

2013

£ million

Profit for the year 450 398

2014

million

2013

million

Weighted average number of ordinary shares used to calculate basic earnings per share 393 393

Weighted average number of dilutive share options 5 5

Weighted average number of ordinary shares used to calculate diluted earnings per share 398 398

Earnings per share

2014

pence

2013

pence

Basic 114.5 101.3

Diluted 113.2 100.0

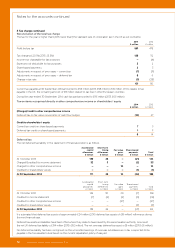

7 Dividends

An ordinary dividend in respect of the year ended 30 September 2014 of 45.4 pence per share, or £180 million, is to be

proposed at the forthcoming Annual General Meeting. These accounts do not reflect this proposed dividend.

An ordinary dividend of 33.5 pence per share, or £133 million, and a special dividend of 44.1 pence per share, or £175 million,

in respect of the year ended 30 September 2013 were both paid in the year ended 30 September 2014.

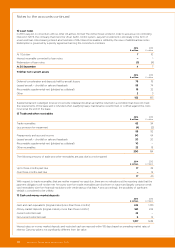

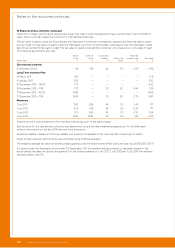

8 Goodwill and other intangible assets

Other intangible assets

Goodwill

£ million

Landing

rights

£ million

Contractual

rights

£ million

Computer

software

£ million

Total

£ million

Cost

At 1 October 2013

365 81 1 34 116

Additions – 13 – – 13

Transfer from property, plant and equipment – – – 10 10

Disposals – – (1) (6) (7)

At 30 September 2014 365 94 – 38 132

Amortisation

At 1 October 2013 – – – 14 14

Charge for the year – – 1 11 12

Disposals – – (1) (6) (7)

At 30 September 2014 – – – 19 19

Net book value

At 30 September 2014 365 94 – 19 113

At 1 October 2013 365 81 1 20 102

During the year, easyJet completed the exchange of certain landing rights at Gatwick Airport from Flybe for a total

consideration of £20 million, £7 million of which was paid in 2013.