EasyJet 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

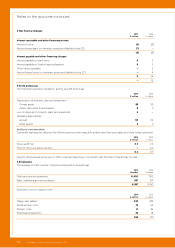

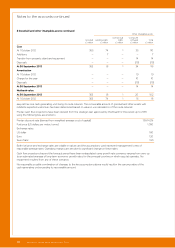

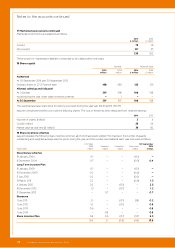

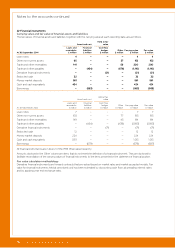

5 Tax charge continued

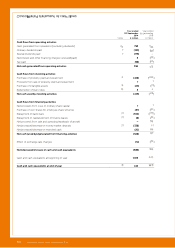

Reconciliation of the total tax charge

The tax for the year is higher than (2013: lower than) the standard rate of corporation tax in the UK as set out below:

2014

£ million

2013

£ million

Profit before tax 581 478

Tax charge at 22.0% (2013: 23.5%) 128 112

Income not chargeable for tax purposes – (4)

Expenses not deductible for tax purposes 3 2

Share-based payments 2 3

Adjustments in respect of prior years – current tax (7) (11)

Adjustments in respect of prior years – deferred tax 8 6

Change in tax rate (3) (28)

131 80

Current tax payable at 30 September 2014 amounted to £53 million (2013: £58 million). £45 million of this relates to tax

payable in the UK, the remaining amount of £8 million related to tax due in other European countries.

During the year ended 30 September 2014 cash tax paid amounted to £96 million (2013: £65 million).

Tax on items recognised directly in other comprehensive income or shareholders' equity

2014

£ million

2013

£ million

(Charge)/credit to other comprehensive income

Deferred tax on fair value movements of cash flow hedges (10) 27

Credit to shareholders' equity

Current tax credit on share-based payments 7 3

Deferred tax credit on share-based payments 1 11

8 14

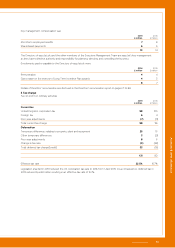

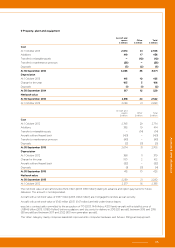

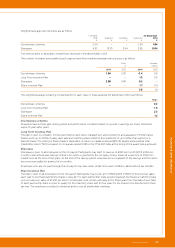

Deferred tax

The net deferred tax liability in the statement of financial position is as follows:

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains

£ million

Share-based

payments

£ million

Total

£ million

At 1 October 2013 139 26

–

(21) 144

Charged/(credited) to income statement 32 3

–

(2) 33

Charged to other comprehensive income

–

–

10

–

10

Credited to shareholders' equity – – – (1) (1)

At 30 September 2014 171 29 10 (24) 186

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains

£ million

Share-based

payments

£ million

Total

£ million

At 1 October 2012 146 30 29 (7) 198

Credited to income statement (7) (4) (2) (3) (16)

Credited to other comprehensive income – – (27) – (27)

Credited to shareholders' equity – – – (11) (11)

At 30 September 2013 139 26 – (21) 144

It is estimated that deferred tax assets of approximately £24 million (2013: deferred tax assets of £18 million) will reverse during

the next financial year.

Deferred tax assets and liabilities have been offset where they relate to taxes levied by the same taxation authority. As a result

the net UK deferred tax liability is £194 million (2013: £152 million). The net overseas deferred tax asset is £8 million (2013: £8 million).

No deferred tax liability has been recognised on the unremitted earnings of overseas subsidiaries as no tax is expected to be

payable in the foreseeable future based on the current repatriation policy of easyJet.